Between Wall Street and Main Street

Between Wall Street and Main Street

The most prominent equity indices are back to pre-pandemic levels and the S&P 500 has touched a new all-time high, intra-day. Indeed, there are plenty reasons for optimism: 6 of the Covid vaccines tracked by the WHO have reached Phase 3 of clinical trials, while Russia has already approved a vaccine for public use; Trump is pondering a capital gains tax cut in the US while Republicans and Democrats on Capitol Hill are expected to reach some sort of agreement on a new fiscal stimulus package. Then there is the old faithful; diligent central banks are still in a “whatever it takes” mindset when it comes to monetary policy.

Indeed, this is all a boon for market sentiment, but it’s also important to take the pulse on main street, to understand how businesses and consumers are faring, and whether we can rely on demand from these groups as one of the key growth catalysts moving forward. Output data for June in advanced economies showed a continuation of the upward trend that kicked off in May: US industrial production rose 5.4% (even the beleaguered auto and auto parts segment showed strong signs of recovery), while the Eurozone equivalent rose 9.1%. At the same time, consumers sprung back into action, with US retail sales rising 7.5%, and the Eurozone equivalent rising 5.7% to pre-pandemic levels.

However, with coronavirus clusters and geopolitical tensions flaring up, and with certain unemployment support schemes expiring, soft data has hinted that businesses and consumers may be losing confidence. If this continues, it will be difficult for hard data to keep coming in in the upper ranges of analyst forecasts.

We must keep in mind that industrial production in the US and the Eurozone, is still 10.9% and 11.6% below February levels (before economic activity came to a halt). We think it will take a few quarters at least for growth rates to normalise (in line with our base case scenario of a check-mark shaped recovery (?), as opposed to a V-shaped recovery which markets appear to have faith in). Current price levels could suggest that Wall Street is racing ahead of main street, leaving room for disappointment.

EQUITIES

After a paradoxical Q2 earnings season (the worst since Q4 2008 on earnings growth but the best since 2008 on positive surprises) analysts still lack clarity on the future, with only 43 S&P 500 companies having issued guidance for Q3. Nonetheless, for the first time since 2018, they are busy revising their forecasts upwards after having massively undershot Q2 earnings. At the time of print, 83% of S&P 500 companies had beaten expectations with their second quarter earnings (the aggregate surprise was 22.4% above estimates). In Europe, 69% of companies registered a positive earnings surprise, with an aggregate surprise of +11%.

However, Q2 is in the rear-view mirror and markets are forward looking. Supported by stimulus and low yields, equity prices have ran faster than upwards earnings revisions, making them very expensive. If aggressive 2021 EPS estimates are to come to fruition (23.8% for the US, 37.6% for Europe and 31.0% for Emerging Markets), economic growth has a lot of catching up to do.

Believing in a more gradual recovery, we prefer to stay neutral on equities for the time being. We keep our preference for large caps, where more quality names are to be found. With regards to style, the outperforming sub sectors and emerging trends favour growth stocks. These should continue as a key driver in a low interest rate environment.

FIXED INCOME

With growth picking up, the next question is – what about inflation? While underlying inflation drivers are still muted, inflation expectations are inching higher and US core inflation came in at +0.6% in July: The biggest monthly increase since 1991. On the other hand, markets are convinced that the dovish Fed will keep short term rates close to zero for the foreseeable future, meaning that higher real yields are only a prospect over a much longer time horizon. We do not believe in a sudden spike in inflation but we do pad out our government bond exposure with inflation-linkers in the event that we see a mild uptick in the readings.

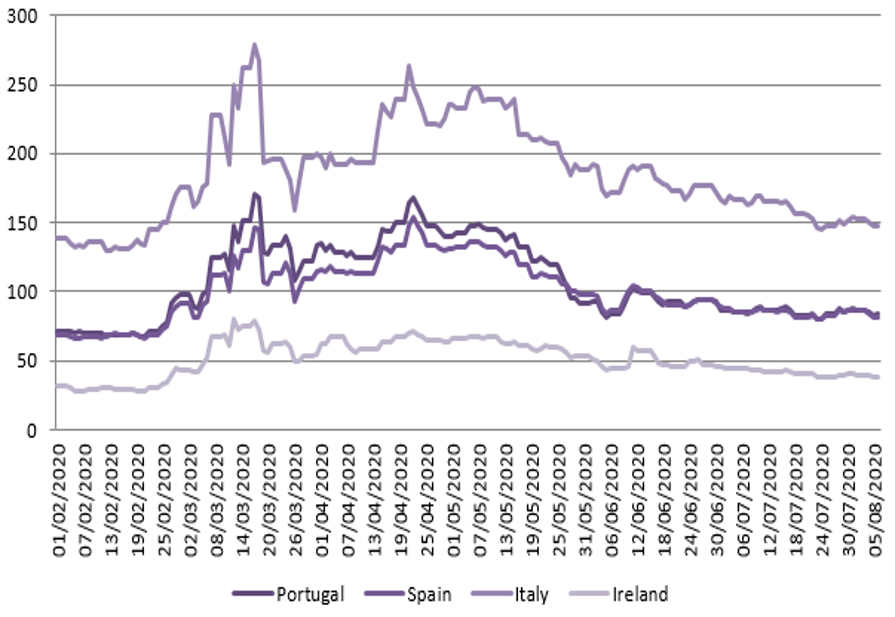

Our overall exposure to government bonds varies in proportion to the amount of equity risk we wish to buffer. Within this space, southern European spreads have continued their retracement, driven by the large increase in the ECB’s Pandemic Emergency Purchase Program (PEPP) and the approval of the EU Recovery Fund, making this asset class more attractive with some opportunity for carry.

Peripheral Spreads

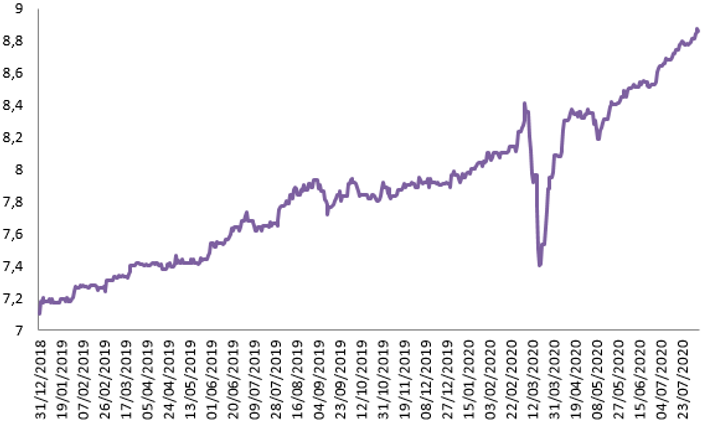

In the corporate bond space, the improving macro outlook builds a case for taking some more credit risk. Investment grade spreads have continued to tighten, helped by central bank purchase programs and corporate earnings which came in better than feared. Valuations are getting expensive, especially for the highest quality tiers. With continued quantitative easing and lighter issuance expected for the second half of the year, IG looks set to become even more expensive, returning to the all-time stretched levels of 2019. Within this segment, investors are encouraged to pay close attention to duration risk, especially in the US, where a drop in yields combined with the fact that companies are tendering old bonds and extending their maturity profile, has led to a sharp increase in duration at benchmark level. This phenomenon is less predominant in Europe.

Duration: US Investment Grade Bonds

As has occurred in IG, high-yield (HY) spreads have continued their tightening trend. Year-to-date,

US HY has outperformed EUR HY, helped by the sharp drop in the base rate, lower hedging costs and the Fed’s inclusion of HY names in its corporate purchases. The outperformance comes despite a default rate of 6.2% for the last 12 months, compared to just 1.8% in Europe. To enhance returns in portfolios with less equity exposure, we have an inclination towards EUR HY, which offers higher credit quality (BB- vs. B+ for the US).

Emerging market debt has received strong inflows as of late, pushing sovereigns (hard currency) to expensive levels. The corporate space is less crowded and looks more appealing, as it indirectly benefits from central bank purchasing in developed markets, through increased liquidity and a compression in global credit spreads. However, with the US elections less than three months away, US-China tensions are re-emerging, while other EMs are still battling to control the first wave of the pandemic. These factors make the risk/reward ratio uncompelling for the time being.

CURRENCY & COMMODITIES

The dollar’s decline has been the focal point in currency markets. The greenback sold off against major currencies such as the euro and the Swiss franc, with the notable exception being the Japanese yen. Our currency experts see 1.20 EUR/USD as a reasonable target and don’t believe a massive dollar depreciation is on the cards. However, if it does break past this point, it is not unreasonable that it goes as far as 1.25, and hedging should be considered.

Gold has continued its dizzying rally (+33.9% YTD), breaking the $2000 level for the first time in early August, mostly driven by USD’s descent. For now, we maintain our exposure, believing that the expansion of central bank balance sheets gives ongoing support. Moreover, any renewed surge in coronavirus cases, as well as increasing inflation expectations could also boost demand.

CONCLUSION

Theodore Roosevelt once said, keep your eyes on the stars, and your feet on the ground. It’s the same in markets. It’s easy to get starry-eyed and tempted by soaring stock markets, but it pays to have a foot on the ground, keeping a feel for the real economy and the mood amongst consumers and companies who drive production, profits and growth. While main street lags well behind Wall Street, we avoid getting carried away in our exposure to risky assets.

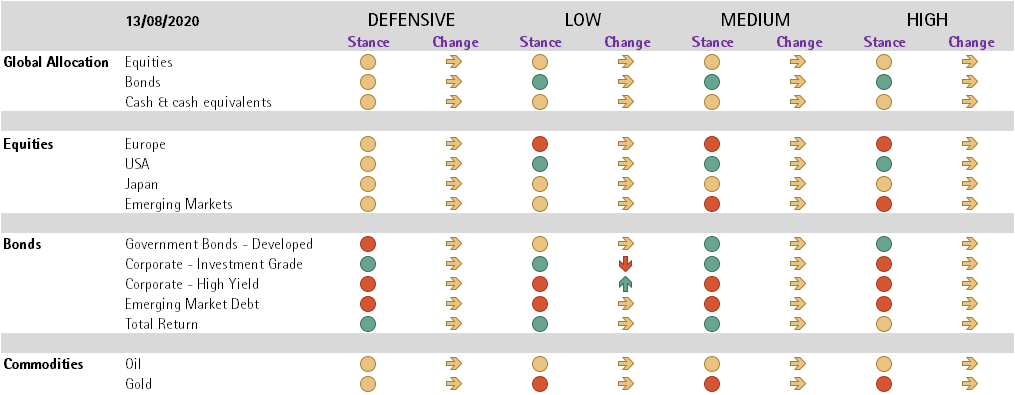

ALLOCATION MATRIX

Change: Indicates the change in our exposure since the previous month’s asset allocation committee

First, please LoginComment After ~