Moscow Exchange announces results for Q2 2022

HIGHLIGHTS FOR Q2 2022

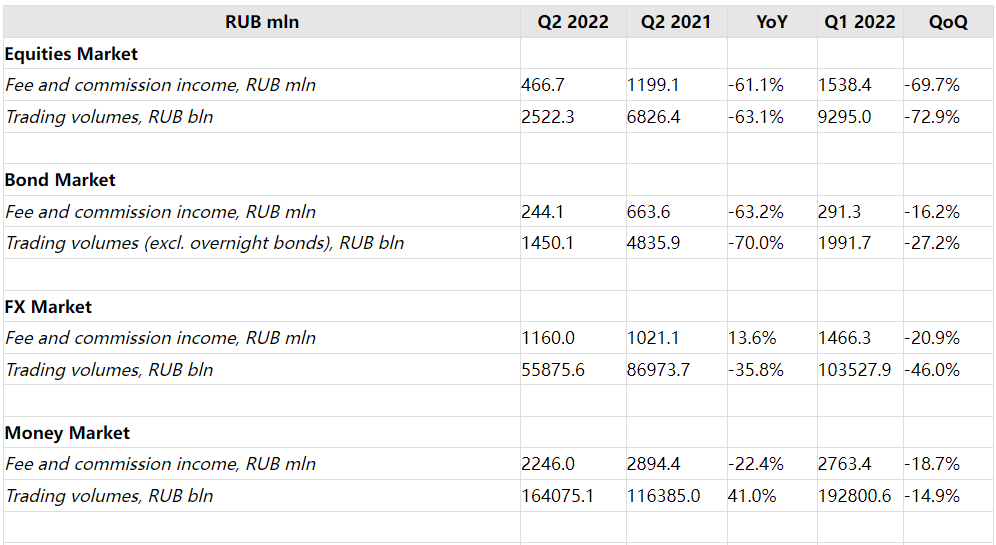

- Fee and commission (F&C) income decreased by 18.8% to RUB 8,056.3 mln.

- During the quarter, MOEX experienced a decline in trading volumes that translated into F&C income contraction. The decline was mainly due to the absence of non-resident trading, lower RUB asset price levels and elevated RUB interest rates.

- EBITDA rose by 17.7% to RUB 11,382.1 mln. Net profit added 19.0% to RUB 8,285.5 mln.

PERFORMANCE OF KEY BUSINESS LINES

- The total market capitalization of the Equities Market as of the end of the second quarter was RUB 40.89 trln (USD 778.90 bln). Fee and commission income from the Equities Market fell by 61.1% on the back of a nearly identical decrease in trading volumes of 63.1%. A slight improvement in effective fee is explained by the ascending tariff structure as trading volumes decrease.

- Fees and commissions from the Bond Market decreased by 63.2% as trading volumes excluding overnight bonds shrank by 70.0% amid a backdrop of adverse interest rate environment. Effective fee dynamics was supported by migration of trading volumes to value-added, CCP-based trading modes.

- Money Market fee income declined by 22.4%. Trading volumes were up 41.0%. The discrepancy between volume and fee dynamics was mainly attributable to a drop in repo terms and a contraction in FX repo activity. Overall on-exchange repo terms on average decreased by 22% to 4.6 days. Average GCC repo terms fell by 68% to 2.5 days.

- Fee income from the FX Market was up 13.6% while trading volumes decreased by 35.8%. The discrepancy in fee and volume dynamics is largely explained by a shift in trading volumes mix towards spot segment. Spot volumes declined 4.4% while swap volumes shrank by 47.1% amid a general economic trend of decreasing FX exposure.

- Derivatives Market fee income was down 49.1% as trading volumes declined by 57.8%. The discrepancy between fee income and volumes dynamics is the result of a shift in the structure of trading volumes. The effective fee dynamics was slightly supported by the new asymmetric tariff structure implemented 2 weeks prior to the end of second quarter. The new tariff structure favors liquidity makers.

- Sales of software and technical services stood virtually flat, adding just 2.5% YoY. Information services line decreased 14.8% on the back of a significant ruble appreciation. Listing and other services declined 41.0% due to lower primary bond market activity. Financial marketplace services fees accounted for RUB 183.1 mln.

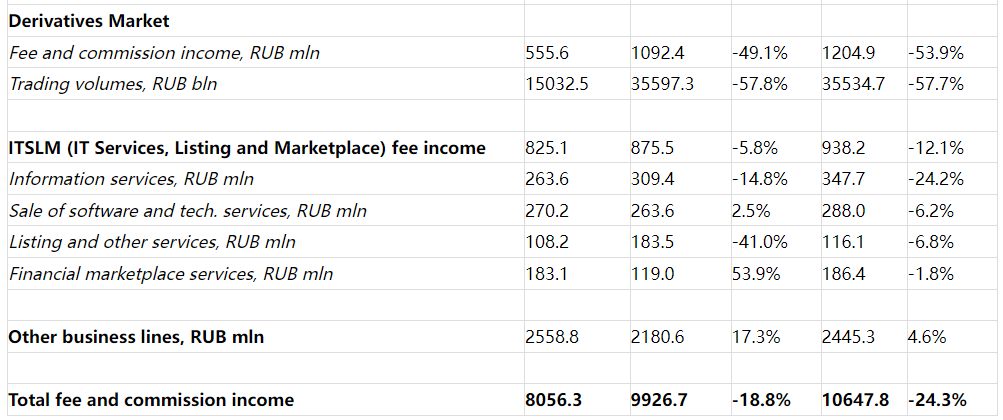

BALANCE SHEET SUMMARY

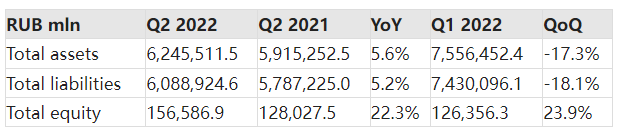

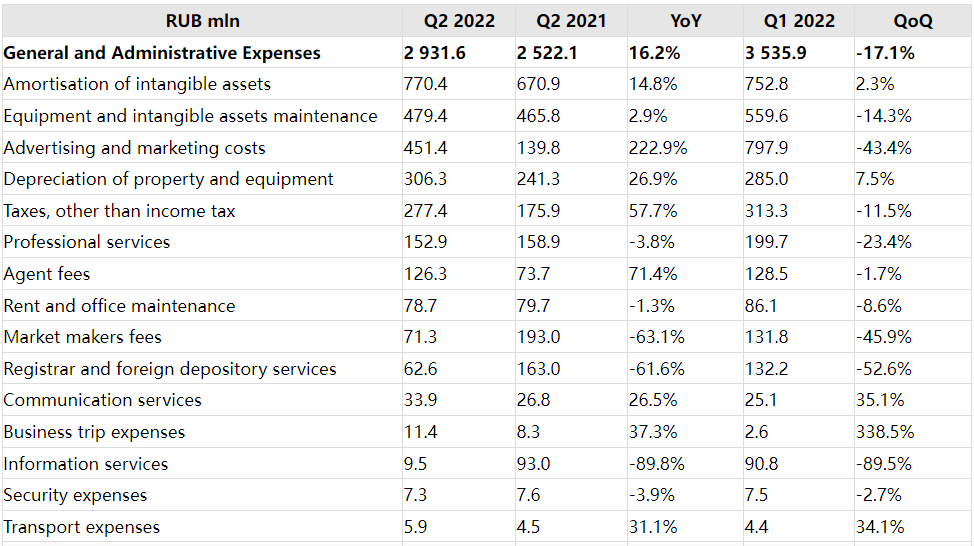

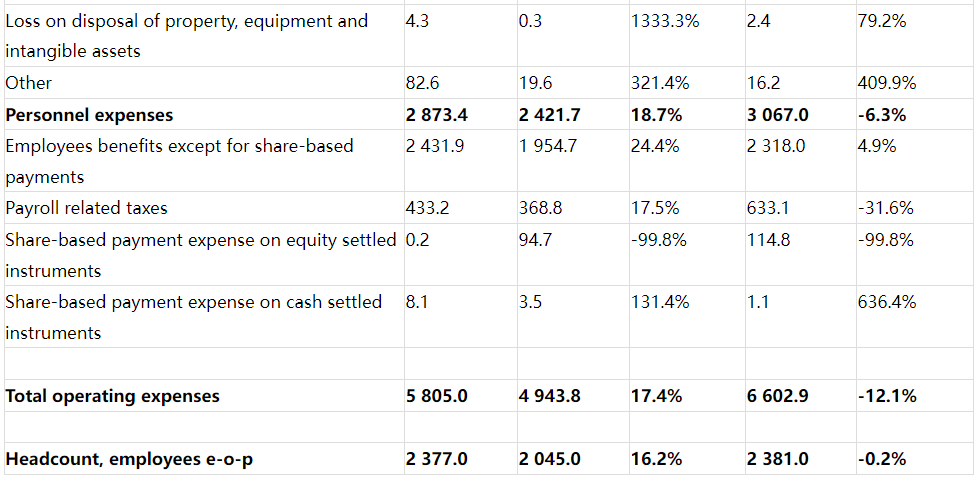

OPEX BREAKDOWN

- Total OPEX for 2Q’22 added 17.4%. Non-organic contribution from Inguru (consolidated in May’21) & NTPro (consolidated in Oct’21) was 2.5 p.p. Total contribution from Marketplace incl. Inguru was 10.3 p.p. Therefore, core business OPEX increased by 7.1%.

- Net of marketing expenses, the largest expense growth factor, OPEX added 11.4% YoY – below the CPI.

- Headcount growth of 16.2% decomposes into: 3.0 p.p. NTPro acquisition, 1.5 p.p. outsourced IT personnel brought in-house, 1.2 p.p. Inguru acquisition, 10.5 p.p. other hires, mainly for Finuslugi.

- Market makers fees contracted on the back of trading volumes decline.

- D&A and IT maintenance added 12.9% on the back of 18.0% growth in D&A. The latter is explained by higher CAPEX of 4Q’21.

- Capex for the quarter was RUB 0.88 bln, mostly attributable to purchases and development of software as well as the development of the Finuslugi platform.

- FY’22 OPEX growth expectation is at or below 20% YoY.

- FY’22 CAPEX guidance: RUB 4.0-5.0 bln.

First, please LoginComment After ~