The Chinese market and RMB assets have long-term attractiveness - Chinese assets in the eyes of foreign institutions

According to information from the China Securities Regulatory Commission, foreign investment has maintained a trend of flowing into A-shares since the beginning of this year, with a net inflow of 170 billion yuan through the Shanghai and Shenzhen Stock Connect from January to May. Why do the Chinese market and RMB assets have long-term attractiveness in the eyes of foreign institutions? From June 1st to 2nd, at the 2023 Global Investor Conference held on the Shenzhen Stock Exchange, multiple foreign institutions launched heated discussions on this matter.

For many foreign institutions, the bullish outlook on RMB assets is mainly based on China's economic fundamentals and growth potential. The Chinese economy is an important engine of economic growth in the Asia Pacific region. China has a wide range of investment opportunities, which is a consensus among foreign investors. We have seen growth potential in many fields,said Pan Xinjiang, CEO of Jingshun Group's Greater China, Southeast Asia, and South Korea regions.

We make asset allocation decisions based on long-term development trends and fundamentals. The Asia Pacific region is a market that we attach great importance to, "said Tess Aton, CEO of Huiying Investment Asia

The 2023 Asian Economic Integration Report released by the Asian Development Bank recently shows that the economic recovery in the Asia Pacific region is largely thanks to China, which contributes 64.2% to the region's economic growth.

In recent years, there has been a clear trend of high-quality development among listed companies in China. The shows that in 2022, A-share listed companies achieved a total revenue of 71.53 trillion yuan, a year-on-year increase of 7.2%, and the overall average R&D intensity was 2.32%, a year-on-year increase of 0.25 percentage points. There are over 2500 listed companies in strategic emerging industries.

Pu Jiangning, Senior Managing Director of Wellington Investment Management Company, revealed that in the past few years, the company's investment volume in China has been continuously expanding, and the weight of Chinese investment in its asset portfolio has increased. Recently, we visited some companies in the tourism and pharmaceutical industries, and I believe these companies are doing very well in globalization and innovation, demonstrating vitality

The trend of green development for A-share listed companies is also more evident. Statistics show that over 1700 listed companies have independently prepared and released ESG (Environmental, Social, and Corporate Governance) related reports for 2022, with a significant increase in the number of companies compared to the previous year.

Ye Jiasheng, head of the Asia Pacific Strategic Index for the S&P Dow Jones Index, said that there is currently a very high level of overseas attention to ESG. In the increasingly open environment of China's capital market, incorporating the ESG framework can better align with international standards and be more favored by overseas ESG investors

In recent years, regulatory authorities have focused on expanding the high-level institutional opening of the capital market and have launched a series of new measures for two-way opening, greatly facilitating the participation of foreign institutions in the Chinese capital market.

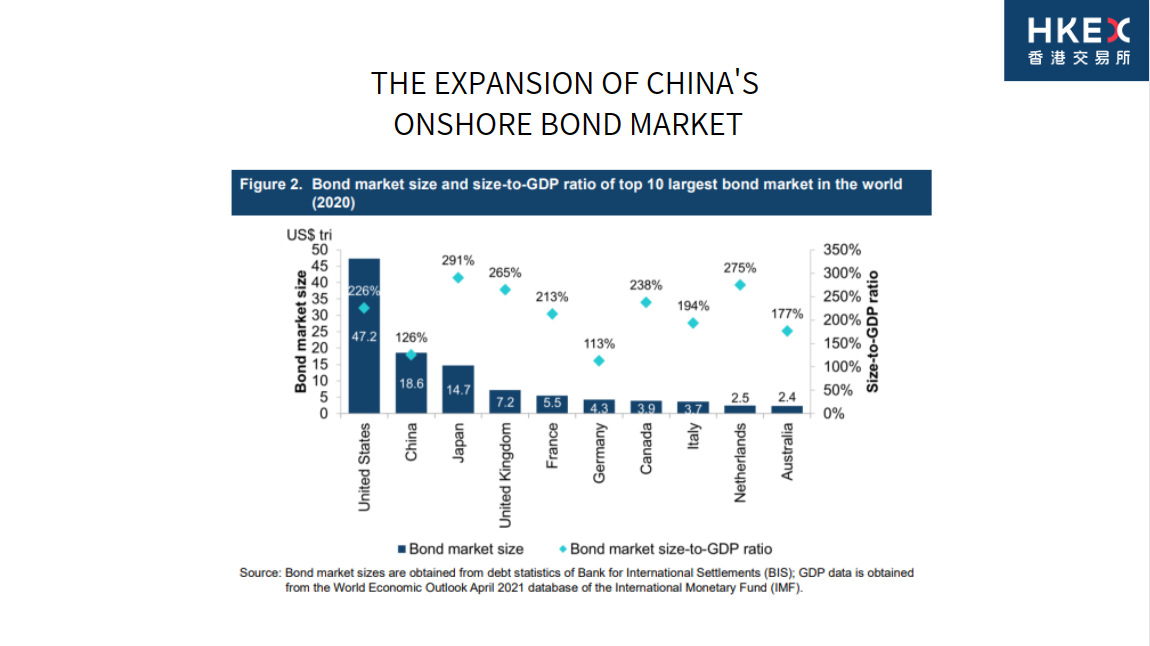

Liu Zehua, Director of China Channel and Strategic Stock Product Department of HSBC, said that in recent years, we have seen the steady upgrading of the QFII/RQFII (Qualified Foreign Institutional Investor/RMB Qualified Foreign Institutional Investor) system, the further expansion of the Stock Connect and Bond Connect plans, and these important developments have had a positive impact on foreign investors.

According to data from the Shenzhen Stock Exchange, the trading volume of QFII, RQFII, and Shenzhen Stock Connect investors in the Shenzhen Stock Exchange has accounted for about 9.5% since the beginning of this year, which is 3.4 times that of five years ago. More and more international investors are participating in investing in the Shenzhen Stock Exchange market.

In April of this year, with the first batch of enterprises listed under the registration system on the main board of the Shanghai and Shenzhen Stock Exchanges, the reform of China's stock issuance registration system was fully implemented.

Zhao Junjie, CEO of Swiss Baida Asset Management Asia (excluding Japan), stated that the Chinese capital market has grown into the world's second largest market and is very important for global investors. The implementation of the registration system can effectively help growing companies in obtaining capital and developing and growing. At the same time, it further promotes the opening of China's capital market and enhances the confidence of global investors

On the 1st, Fang Xinghai, Vice Chairman of the China Securities Regulatory Commission, stated that with the implementation of the registration system reform, the number of A-share listed companies has significantly increased, with a total of over 5000 and a total market value of over 85 trillion yuan.Markets such as bonds, funds, REITs, indexes, futures and derivatives have developed steadily and rapidly, providing global investors with one-stop and diversified investment options.

Multiple foreign institutions have stated that with the continuous deepening of China's capital market reform and opening up, the depth and breadth of the market will continue to expand, and the convenience of investment and financing will also be further improved. which will help foreign investors better participate in China's capital market and share development dividends.

First, please LoginComment After ~