Monetary Policy Guidelines for 2024–2026

Principles and goals

The goal of monetary policy is to protect the ruble and ensure its strength through maintaining price stability. The inflation target is annual inflation of close to 4%.

Price stability is a key element of macroeconomic stability along with a well-balanced fiscal policy. These conditions help form a stable and predictable economic environment. As a result, companies can better plan their operations, and investors are more inclined to provide financial resources. Debt and equity financing is becoming more affordable, including owing to lower interest rates. Households’ incomes and savings are protected against unpredictable depreciation, which preserves their purchasing power. This is critical considering that companies are gradually refocusing from external to domestic markets. Thus, steadily low inflation promotes favourable conditions for investment and economic development. In addition, price stability in the country increases confidence in the ruble as a currency for international settlements and contracts.

According to the analysis carried out within the Bank of Russia's Monetary Policy Review in 2021–2023, the Bank of Russia's monetary policy helped successfully overcome crises and increase public welfare. This is evidence of the benefits of the inflation targeting strategy in the conditions of various challenges.

Monetary policy principles

Setting a permanent public quantitative inflation target

Implementation of monetary policy in the conditions of a floating exchange rate

Key rate and communication as monetary policy instruments

Monetary policy decision-making based on the macroeconomic forecast

Monetary policy in late 2022 and 2023

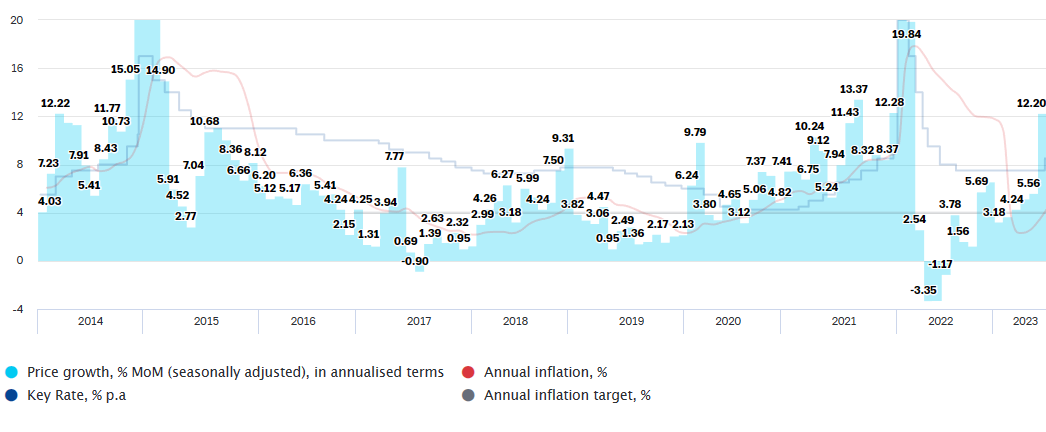

Bank of Russia key rate and inflation

Sources: Rosstat, Bank of Russia.

❶ Maintaining the key rate amid a gradual rise in current inflation pressure from decreased levels (late 2022–2023 H1)

❷ Increasing the key rate due to rising inflation pressure and surging proinflationary risks (July 2023)

On 21 July 2023, the Bank of Russia raised the key rate from 7.5% to 8.5% per annum

❸ Future decisions

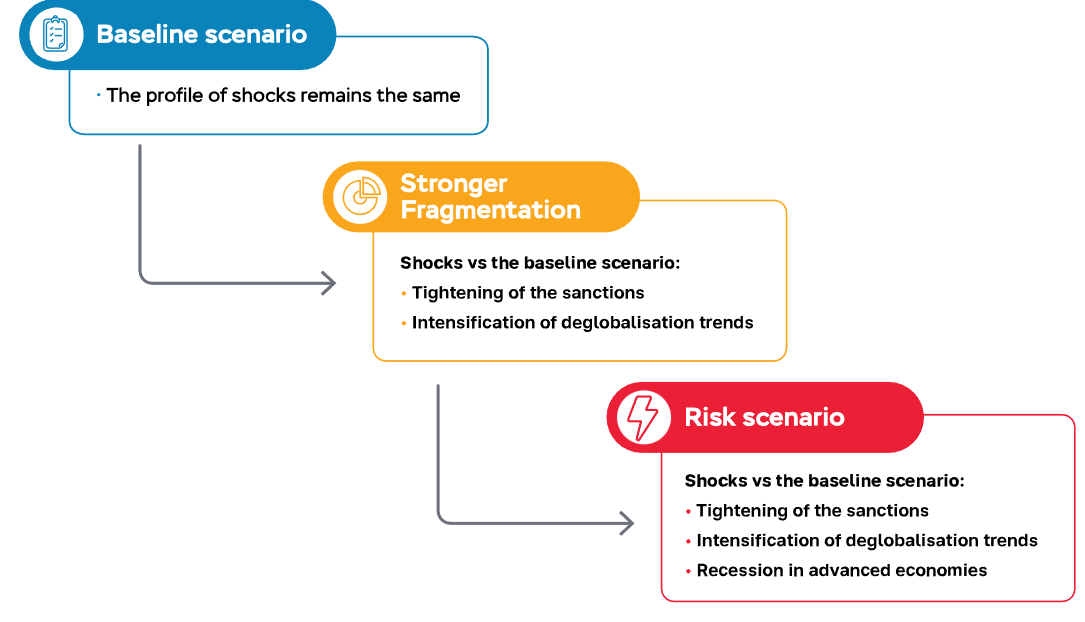

3Forecast scenarios

Further developments in the Russian economy depend on a number of internal and external conditions.

Speaking of internal conditions, the critical factor is how efficiently the Russian economy will continue to adapt to the enacted external restrictions.

As regards external conditions, the key factors are the progress of fragmentation in the world economy, inflation trends and monetary policy measures in advanced economies, changes in the financial position of emerging market economies that have accumulated large foreign currency debts, and geopolitical developments. Depending on the combination of these key conditions, the Bank of Russia considers possible developments in its baseline and two alternative scenarios.

Baseline scenario

| 2022 (actual) | 2023 | 2024 | 2025 | 2026 | |

|---|---|---|---|---|---|

| Annual inflation | 11.9 | 5.0 — 6.5 | 4.0 | 4.0 | 4.0 |

| Gross domestic product | -2.1 | 1.5 — 2.5 | 0.5 — 2.5 | 1.0 — 2.0 | 1.5 — 2.5 |

| — % change in Q4 YoY | -2.7 | 1.0 — 2.0 | 0.5 — 2.5 | 1.0 — 2.0 | 1.5 — 2.5 |

| Key rate, % p.a., yearly average | 10.6 | 7.9 — 8.3 | 8.5 — 9.5 | 6.5 — 8.5 | 5.5 — 6.5 |

| Banking system’s claims on the economy in rubles and foreign currency, including: | 12.0 | 13 — 17 | 9 — 14 | 8 — 13 | 8 — 13 |

| ● on organisations | 13.2 | 12 — 16 | 9 — 14 | 8 — 13 | 8 — 13 |

| ● on households, including: | 9.4 | 15 — 19 | 8 — 13 | 8 — 13 | 8 — 13 |

| — housing mortgage loans | 17.6 | 17 — 21 | 10 — 15 | 10 — 15 | 10 — 15 |

Source: Bank of Russia.

In the baseline scenario, the world economy continues to develop within the already existing trends, provided there are no new shocks. Advanced economies' central banks will pursue tight monetary policies seeking to bring inflation back to targets. As a result, the expansion of the world economy will slow down, limiting price growth in most commodity markets. The sanctions enacted against the Russian economy will remain over the entire forecast horizon. Russian export goods will still be sold in the global market with discounts.

In 2024–2025, the transformation of the Russian economy will progress further. In 2026, it will return to a balanced growth rate of 1.5–2.5%.

Inflation will decrease to the target at the end of 2024 and stay close to 4% further on. This will be facilitated by the Bank of Russia’s monetary policy. In its baseline scenario, the Bank of Russia forecasts that the average key rate will be in the range of 7.9–8.3% per annum in 2023, 8.5–9.5% per annum in 2024, and 6.5–8.5% per annum in 2025. By 2026, the Bank of Russia will return the key rate to its long-term neutral range estimated at 5.5–6.5% per annum.

Stronger Fragmentation

The alternative Stronger Fragmentation scenario assumes that the world economy will become more fragmented, with increasingly more countries dividing into blocks. This process began in 2018–2019 and, in 2022, was exacerbated by intensifying geopolitical tensions. If the global fragmentation becomes stronger, countries will be seeking to localise their production capacities in their territories, limit competitors' access to domestic economies and technologies, and establish partnerships with neighbouring countries and geopolitical allies.

The pressure of the sanctions on the Russian economy might become more severe. The division into regional blocks will have an adverse effect on global trade, hampering the growth of the world economy and provoking a decline in prices in global commodity markets. As a result, the growth rates of the Russian economy in 2024–2025 will be lower than those in the baseline scenario.

The shrinkage of imports due to stronger sanction pressure, coupled with domestic production constraints associated with a shortage of imported components, will exacerbate the gap between demand and supply, pushing up prices. In the case of the Stronger Fragmentation scenario, inflation will again rise in 2024 at a moderate pace of up to 5.0–7.0%. To bring inflation back to the target, the Bank of Russia will have to pursue tighter monetary policy in 2024–2025 compared to the baseline scenario. Inflation will return to the target later, namely in 2025.

Risk scenario

The alternative Risk scenario assumes that inflation pressure in advanced countries will persist, forcing the central banks tighten their monetary policies further. Rapid increases in their policy rates will worsen the situation for financial institutions.

Materialisation of interest rate risk in the financial market might augment the uncertainty and lead to an extensive withdrawal from risky assets. This might entail a global crisis, the scale of which might be comparable with the 2007–2008 crisis. Deglobalisation in this scenario will magnify the negative effects of the financial crisis. The sanction pressure on the Russian economy might intensify. If the largest economies face a recession, global demand will contract. Oil prices will plummet.

Output in Russia’s economy will be shrinking for two years. The economy will start to recover as late as 2026, growing by 2.0–3.0%, and return to a balanced growth path beyond the forecast period.

In the case of the Risk scenario, inflation will speed up to 11–13% in 2024 due to more severe supply shocks and a weaker ruble. To prevent inflation from spiralling out of control, the Bank of Russia will be forced to considerably tighten its monetary policy, with the key rate averaging 12.5–13.5% per annum in 2024. In 2025, in order to limit inflation risks and ensure the return of inflation to the target, the Bank of Russia will also pursue tighter monetary policy than under the baseline scenario. Inflation will return to the target in 2025.

Use of monetary policy instruments

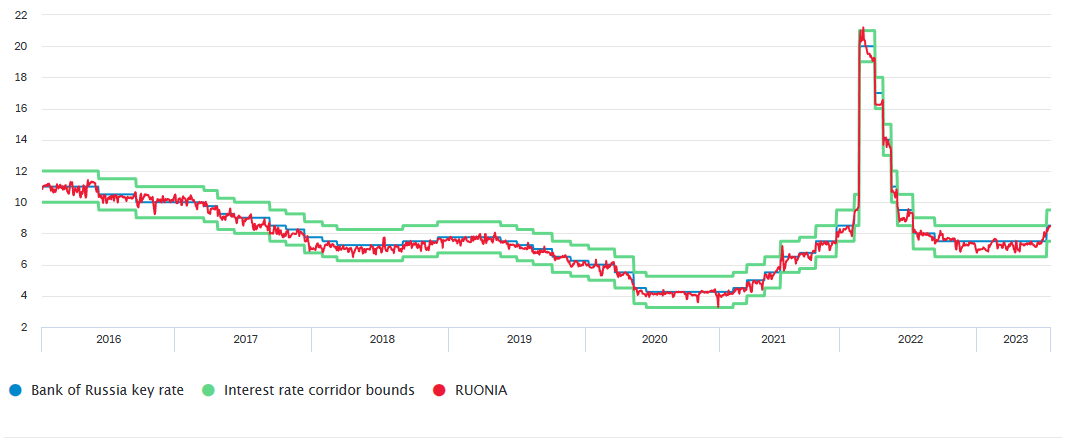

Money market rates

(% p.a.)

Source: Bank of Russia.

Use of monetary policy instruments

The operational objective of the Bank of Russia's monetary policy is to keep overnight money market rates close to the key rate. The operational benchmark is RUONIA. To achieve its operational objective, the Bank of Russia employs a system of instruments (auctions and standing facilities to provide and absorb liquidity, and required reserves). The studies and consultations with market participants within the Monetary Policy Review prove that the developed system of monetary policy instruments takes into account the specifics of the Russian economy and financial sector and enables the Bank of Russia to maintain interbank lending (IBL) rates close to the key rate, whatever is the situation with the banking sector liquidity. IBL rates in turn influence other interest rates in the economy and, thus, the Bank of Russia can translate its monetary policy signal into the economy and impact inflation.

In 2023, the Russian banking sector was functioning in the conditions of a structural liquidity surplus. Overnight money market rates were mostly in the lower half of the interest rate corridor. In January—July 2023, the deviation of RUONIA from the key rate (the spread) averaged −25 basis points, which is slightly more than in 2021–2022. This was associated with a significant inflow of budgetary funds into the banking sector and the specifics of their distribution across the banking sector. As credit institutions adjusted to these changes and the funds received redistributed, the spread narrowed.

In 2023, the Bank of Russia is going to transform the standard liquidity providing mechanism into the main and additional ones. The terms of raising funds by banks will depend on the objective of the operations. In the next few years, the Bank of Russia will continue to develop its system of monetary policy instruments, taking into account the situation with the banking sector liquidity, the specifics of the financial market, and the payment and financial infrastructure.

......

First, please LoginComment After ~