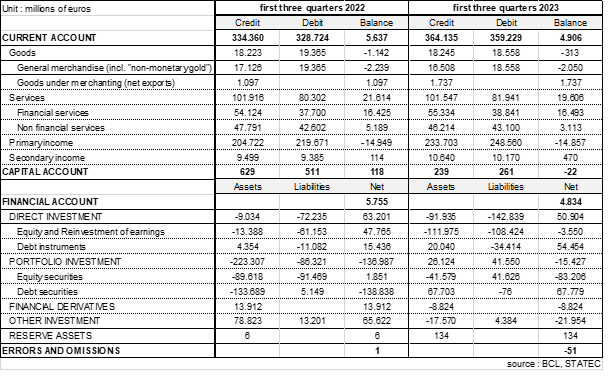

BALANCE OF PAYMENTS OF LUXEMBOURG DURING THE FIRST THREE QUARTERS OF 2023

The Banque centrale du Luxembourg (BCL) and STATEC inform that, according to the first provisional results, the current account for the first three quarters of 2023 showed a surplus of 4 906 million euros, a decrease of 730 million compared to the same period of the previous year.

The goods deficit stood at -313 million euros and this deficit decreased in the first three quarters of 2023 (+829 million euros). For exports and imports of goods, exports remained stable while imports decreased by -4%. Net exports from goods under merchanting (purchases of goods abroad and their resale abroad) went up (+640 million euros). For general merchandise (i.e. excluding merchanting), exports went down -3.6% -618 million euros), while imports also decreased by -4.2% (-807 million euros).

The balance of international trade in services fell by -9.3% in the first three quarters of 2023 (-2 008 million euros), due to the fact that exports decreased (-0.4%) but imports increased (+2.0%). At the level of sub-items, evolutions were diverse. Trade in non-financial services decreased for exports (-3.3%) and increased for imports (+1.2%). International trade in financial services, meanwhile, posted moderate growth, with +2.2% for exports and +3.0% for imports. This evolution is driven mainly by the slight increase in average assets managed by investment funds during the period under review (+2%).

In the financial account for the first three quarters of 2023, direct investment flows are still characterized by large disinvestments for both assets (-91 billion euros) and liabilities (-143 billion euros) sides. Theses disinvestments concern a small number of SOPARFI’s that are continuing restructuring, ceasing or reallocating their activities.

When it comes to portfolio investments, transactions of Luxemburgish equities result in net inflows of 41 billion euros during the first three quarters of 2023, compared with net outflows of 91.5 billion euros during the same period in 2022. On the other hand, Luxembourg debt securities experience net outflows of 76 million euros, compared to net inflows (5 million euros) during the first three quarters of 2022.

For their part, transactions in foreign equity securities result in net outflows of 41 billion euros, compared to net sales of 89 billion euros for the first three quarters of 2022. Foreign debt securities register 67 billion euros net purchases during the first three quarters of 2023, which differs significantly to the same period in 2022 where we had net sales for an amount of 134 billion euros. In a context of increasing interest rates, investors are partially reallocating their portfolio towards debt securities rather than equities.

Detailed statistical tables are available on BCL’s website (www.bcl.lu) as well as on the website of STATEC (www.statistiques.lu).

Table: Balance of payments of Luxembourg

First, please LoginComment After ~