MAS Monetary Policy Statement - January 2024

INTRODUCTION

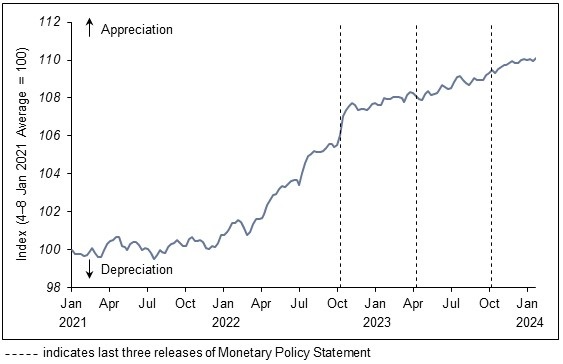

1. In the October 2023 Monetary Policy Statement (MPS), MAS maintained the rate of appreciation of the Singapore dollar nominal effective exchange rate (S$NEER) policy band, with no change to the width of the band or level at which it was centred. Since then, the S$NEER has strengthened in line with the appreciating policy band.

Chart 1

S$ Nominal Effective Exchange Rate (S$NEER)

GROWTH BACKDROP

2. Economic activity in Singapore’s major trading partners was resilient in the last quarter of 2023. In the near term, global growth is expected to be impacted by the lagged effects of elevated interest rates in the advanced economies. However, global final demand should pick up later this year, as lower inflation sustains private consumption expenditure, and monetary policy settings in the major economies turn more supportive. This outlook is subject to uncertainties, particularly stemming from ongoing geopolitical conflicts which could precipitate negative global supply and demand shocks.

3. MTI's Advance Estimates show that growth in the Singapore economy picked up to 1.7% on a quarter-on-quarter seasonally-adjusted basis in the last quarter of 2023, from 1.3% in Q3 and an average of −0.1% in the first half of the year. This strengthening in momentum was mainly attributable to the external-facing sectors. For 2023 as a whole, the Singapore economy is estimated to have expanded by 1.2%.

4. Prospects for the Singapore economy should continue to improve in 2024, with GDP growth projected to come in between 1–3%. The recovery in the manufacturing and financial sectors should be supported by the turnaround in the electronics cycle and anticipated easing in global interest rates, respectively, even as growth in the domestic-oriented sectors further normalises towards pre-pandemic rates. Consequently, the slightly negative output gap in 2023 will narrow in the second half of 2024.

INFLATION OUTLOOK

5. MAS Core Inflation [1] continued to decline in year-on-year terms in Q4 2023, though by less than expected. Inflation for food and retail goods moderated, offsetting firmer electricity & gas inflation. Travel-related services inflation, which is largely determined by conditions in tourism markets abroad, was stronger as hotel room rates and package tour prices saw steep increases. For 2023 as a whole, MAS Core Inflation came in at 4.2%, slightly higher than the 4.1% in 2022. However, excluding the impact of the GST increase, core inflation would have fallen by an estimated 0.6%-point in 2023 compared to 2022.

6. CPI-All Items inflation likewise edged down in Q4 2023 from the preceding quarter. Accommodation inflation eased as the supply of completed housing units increased. This helped to offset rising private transport inflation amid higher petrol prices. CPI-All Items inflation averaged 4.8% in 2023, down from 6.1% in the preceding year.

7. MAS Core Inflation is expected to rise in the current quarter due in part to the one-off impact of the 1%-point hike in the GST from January this year, as well as the increase in the carbon tax. Water prices will rise from Q2 this year amid increases in production costs. Inflation for certain services components, including public transport and healthcare, could also stay elevated as less frequently-adjusted prices rise to catch up with higher cost levels.

8. Setting aside the transitory impact of the GST increase, core inflation is forecast to decline gradually over 2024. Lower imported costs and a slower pace of domestic cost increases should underpin the moderating trend in inflation. Global energy and food commodity prices have fallen and are expected to remain broadly stable, while imported costs of most intermediate and final goods should be tempered by favourable global supply conditions. On the domestic front, wage growth should ease this year as labour market tightness dissipates, while productivity is also projected to pick up. Consequently, unit labour costs will rise at a slower pace.

9. MAS Core Inflation is projected to slow to an average of 2.5–3.5% for 2024 as a whole, unchanged from the October 2023 MPS. Excluding the impact of the increase in the GST rate this year, core inflation is forecast at 1.5–2.5%.

10. Amid the declines in COE premiums since November and the larger COE supply this year compared to 2023, CPI-All Items inflation in 2024 is now forecast to be lower at 2.5–3.5%, down from the previous range of 3–4%. Excluding the effects of the increase in the GST rate, headline inflation is forecast at 1.5–2.5%.

11. Both upside and downside risks to the inflation outlook remain. Shocks to global food and energy prices or domestic labour costs could bring about additional inflationary pressures. However, an unexpected weakening in the global economy could induce a faster easing of cost and price pressures.

MONETARY POLICY

12. Barring any further global shocks, the Singapore economy is expected to strengthen in 2024, with growth becoming more broad-based. MAS Core Inflation is likely to remain elevated in the earlier part of the year, but should decline gradually and step down by Q4, before falling further next year.

13. Accordingly, current monetary policy settings remain appropriate. The sustained appreciation of the policy band will continue to dampen imported inflation and curb domestic cost pressures, thus ensuring medium-term price stability.

14. MAS will therefore maintain the prevailing rate of appreciation of the S$NEER policy band. There will be no change to its width and the level at which it is centred. MAS will closely monitor global and domestic economic developments, and remain vigilant to risks to inflation and growth.

***

[1] MAS Core Inflation excludes the costs of accommodation and private transport from CPI-All Items inflation.

First, please LoginComment After ~