A detailed review of the latest investment and development in Zambia's mining industry

Zambia’s mining industry remains a cornerstone of its economy, particularly driven by its status as one of the world's top copper producers. Recent developments have brought fresh investments and expansions, promising to reshape the industry amidst fluctuating global commodity prices.

Significant Investments and Strategic Developments.

The Zambian mining landscape has recently seen substantial investments that signal confidence in the country's mineral wealth and regulatory environment.

Barrick Gold Corporation’s Lumwana Expansion: Barrick Gold has committed a significant investment of $1.3 billion to expand the Lumwana Copper Mine. This initiative is projected to extend the mine's operational life by at least 20 years. The expansion plan includes upgrading existing plant infrastructure, introducing cutting-edge mining technology, and expanding the waste management systems. This project aims to increase the mine’s annual copper output by approximately 45%, enhancing its total production capacity to over 270,000 tonnes of copper per year.

First Quantum Minerals’ Kansanshi Expansion: First Quantum Minerals has announced a $2 billion investment to develop the S3 expansion at the Kansanshi mine, which is Zambia’s largest copper mine.

This expansion is expected to increase copper output significantly, adding an estimated 100,000 tonnes of copper annually once completed. The project includes the construction of a new processing plant and the development of two new open pits. This expansion is critical as it ensures the longevity of the mine up to 2044.

Zijin Mining’s Investment in the Lower Zambezi: Chinese mining giant Zijin Mining has initiated a $380 million project to develop a new copper mine in the Lower Zambezi region. This development is particularly noteworthy as it marks a major Chinese investment in Zambia under the new governmental agreements focused on sustainable mining practices. The project promises to adopt environmentally friendly technologies and methods to minimize ecological impact.

High Potential Sectors and Geographical Locations.

The following sectors and locations in Zambia are identified as high-potential opportunities for mining and exploration:

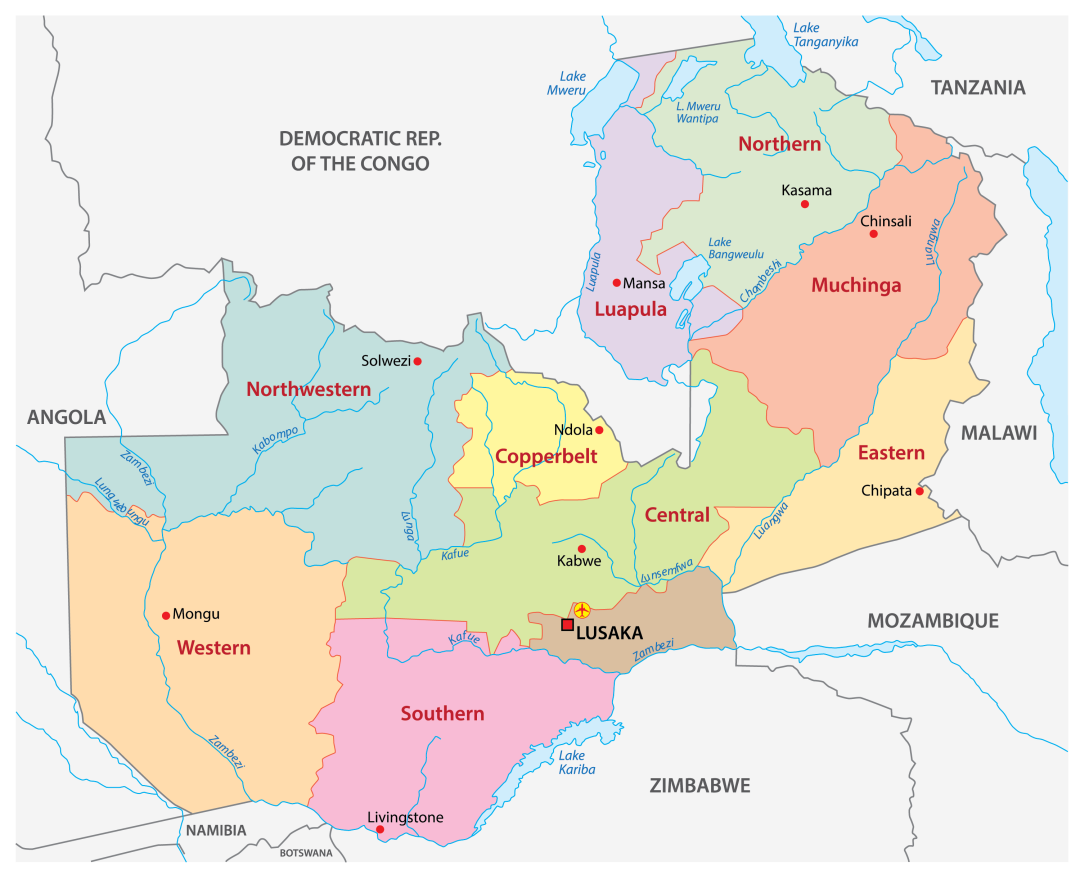

Copperbelt Province: Traditional stronghold for copper but also showing potential for cobalt and nickel, critical for battery technology.

North-Western Province: Emerging as a new hub for gold and precious stones mining, with significant untapped deposits.

Eastern Zambia: Known for high-quality amethyst mining, with potential for expansion and introduction of new mining technologies.

Challenges Facing the Industry.

Despite these optimistic developments, Zambia's mining sector faces several challenges:

Energy Supply:

The frequent power shortages in the country pose a significant risk to mining operations, often leading to increased operational costs due to the need for alternative power solutions.

Regulatory Environment:

Recent changes in the tax regime and mining policies have created uncertainties that could affect future investment decisions.

Environmental Concerns:

There is growing scrutiny from both local communities and international observers regarding the environmental impact of mining activities, especially concerning water usage and pollution.

Strategic Investment Opportunities.

Advanced Exploration Technologies:

Investing in geophysical and geochemical survey technologies can uncover new mineral deposits in less explored regions like the Luapula Province, which shows potential for nickel and cobalt. Implementing drone technology and 3D seismic imaging can reduce exploration costs by up to 20% and speed up the discovery process.

Infrastructure Development Partnerships:

Engaging in public-private partnerships (PPPs) for the development of infrastructure (roads, power, and water supply) in mining areas can reduce operational costs and enhance project feasibility. For example, investing in solar power infrastructure can decrease energy costs by 15-25%, considering Zambia's high solar energy potential.

Automated and Eco-friendly Mining Operations:

Adopting automated mining operations and eco-friendly mining methods can increase efficiency and reduce environmental impact. Investment in automated drilling and ore handling systems could increase operational efficiency by approximately 30%, while reducing environmental remediation liabilities.

Actionable Steps for Potential Investment.

Conduct Comprehensive Feasibility Studies:

Before committing capital, conduct detailed feasibility studies that include environmental impact assessments, market analysis, and logistical evaluations. These studies help in understanding the potential returns and the sustainability of the investment.

Engage with Local Communities and Authorities:

Building strong relationships with local communities and government authorities can facilitate smoother operations and ensure compliance with local regulations. Engaging in community development projects can also enhance corporate social responsibility and local support for projects.

Diversify Investments Across Commodities:

To mitigate risks associated with price volatility in the commodities market, diversify investments across different minerals and metals. This strategy not only stabilizes revenue streams but also capitalizes on different market cycles for various commodities.

Conclusion.

Investing in Zambia’s mining sector offers significant opportunities given the country's rich mineral resources and improving regulatory framework. However, success in this sector requires strategic planning, adoption of advanced technologies, and a strong commitment to sustainable practices. By following these actionable steps and focusing on realistic outcomes, investors can maximize their returns while contributing to the economic development of Zambia.

This in-depth analysis provides a solid foundation for industry insiders to make informed decisions and develop robust investment strategies in Zambia's dynamic mining sector.

First, please LoginComment After ~