Temasek Review Media Conference 2024: FAQs

The following is an edited transcript of questions and answers at the Temasek Review 2024 Media Conference.

Grammatical edits have been made to aid readability. For the same reason, questions are not necessarily listed in the order in which they were asked, but grouped thematically.

Slides and charts have been added from the Temasek Review 2024 where they were included in the presentation, or where they contain material helpful to the reader in providing detail to supplement the answer.

Click here to read the transcript of the preceding presentation and accompanying slides, and here to view all of the key financial metrics and diagrams in Temasek Review 2024.

Question on Net Portfolio Value (NPV)

QUESTION: I looked through some of your bond issuance documents and your previous Temasek Reviews. I cannot see any mention of mark to market NPV in the last two years. This is the first instance I have been able to see it. Are you able to identify exactly where in your previous reports you have shared that and why did you put it out this year? I know it is your 50th birthday and an election year – does it relate to that? Could you provide us with more colour on this?

CHIA SONG HWEE: If you were to refer to our press release in 2022, that was the first time that we have mentioned it, and it has been in our press releases ever since. So that is what we have disclosed.

LENA GOH: It is also in our media slides, presentation slides, and the transcript for the last Temasek Review1.

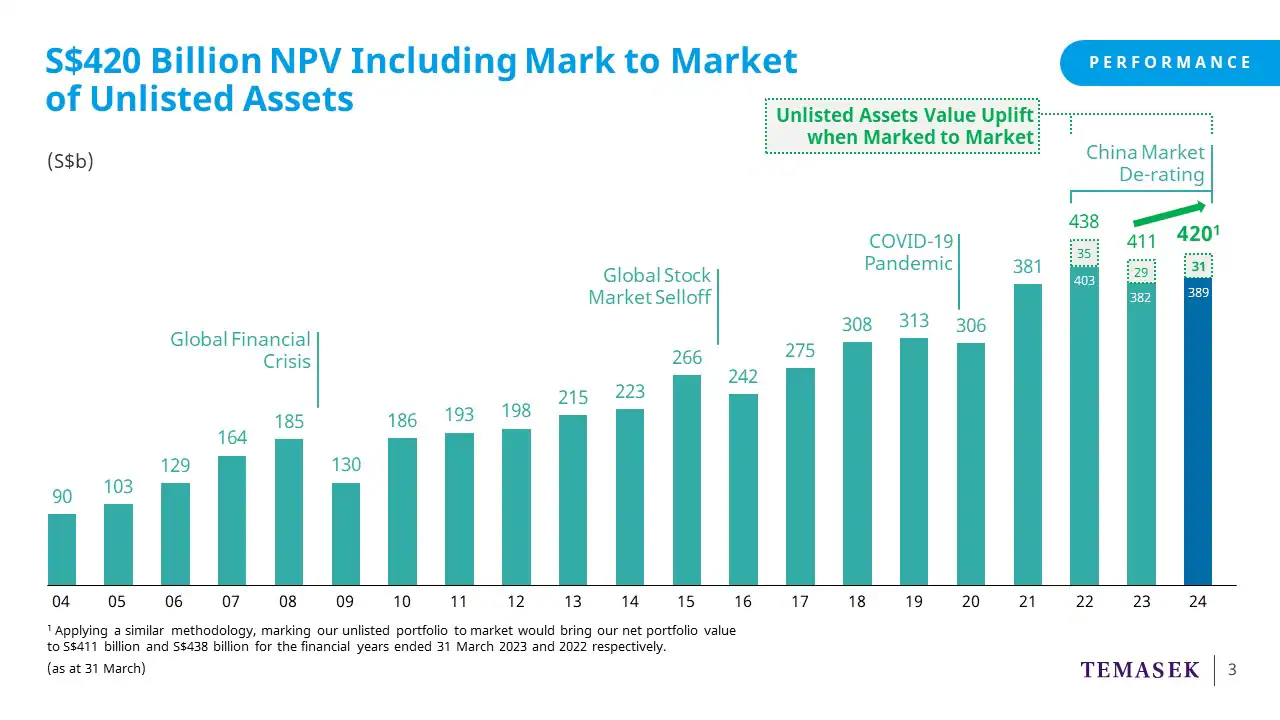

CHIA SONG HWEE: Yes, but more importantly, what is the concept of mark to market and why did we decide to disclose that data point three years ago. When we look at investments at the asset level, as well as portfolio level, we obviously track and monitor the progress of the underlying business – the profitability, the growth and so on – but also the market value.

That view of market value informs us on, firstly, whether we should be holding, adding, or selling the position. It also informs us if there are certain actions we should take, working alongside the portfolio companies on value enhancement, so that the value can be materialised. It is something that all investors do as a matter of routine workflow.

It also allows us to have a more transparent disclosure of the value and benchmark with our peers in terms of how we do over time. That is the main purpose of us making the disclosure. It has got nothing to do with the short-term implication of the portfolio value. As you can see from the chart, it is not to show the good side of it. You can see that between the three periods, there will be down years. What it actually suggests is that we will have more volatility in the portfolio as we show these data points.

______________________

1 TR22 Q&As: If we were to mark to market, this unlisted portfolio value will rise another 10%.

https://www.temasek.com.sg/en/news-and-resources/news-room/news/2022/temasek-review-2022-faq#item_604774484

TR23 presentation: But if we were to mark it (unlisted assets) to market, it would provide an uplift of about 18 billion dollars to our portfolio.

https://www.temasek.com.sg/en/news-and-resources/news-room/speeches/2023/temasek-review-2023-media-conference

Question on Total Shareholder Return (TSR)

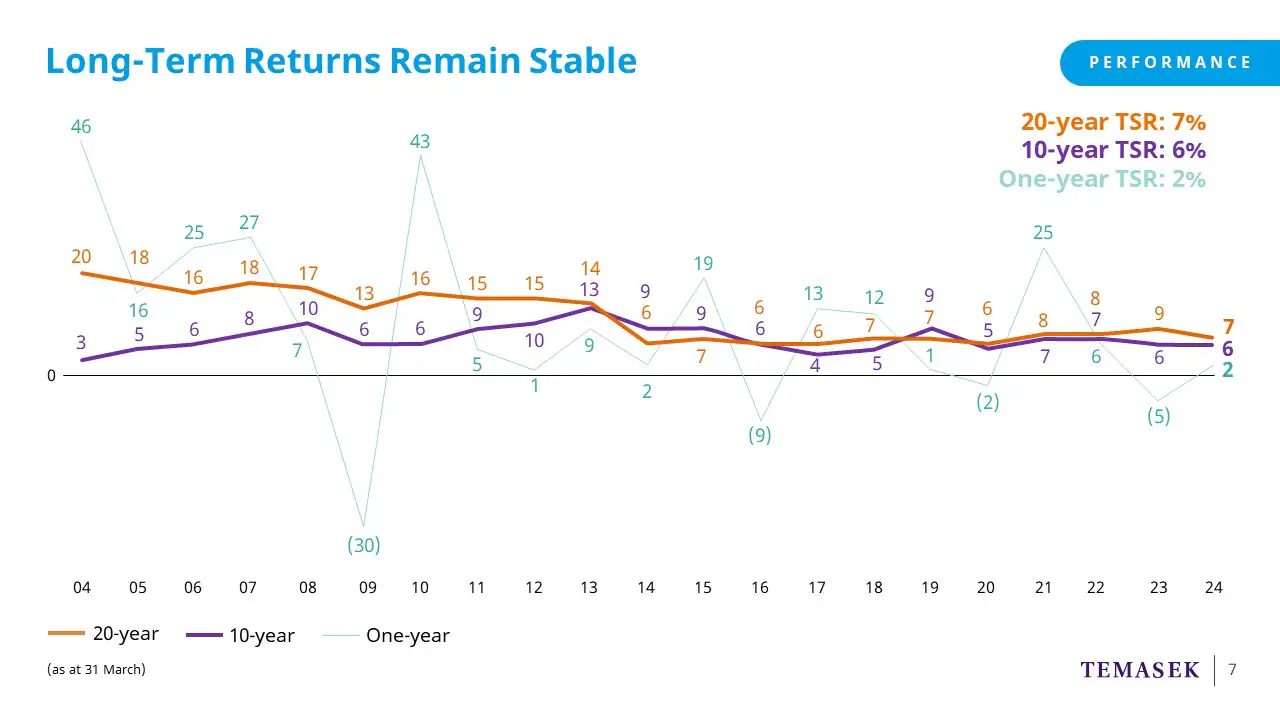

QUESTION: As you have rightly pointed out, the 10-year and 20-year TSR have been fairly stable, as opposed to the one-year TSR, which has been slightly more volatile. How concerned are you about the one-year TSR, which has seen a seven-percentage point swing, and is the focus more on the 10- and 20-year longer-term returns and, if so, why? If you could elaborate a bit more about how that relates to the NIR framework and why that is a little more important for you guys to watch?

CHIA SONG HWEE: Firstly, 10-, 20-year returns are our main focus. For the type of capital that we have, it is well-suited for us to take a long-term view and invest with that in mind. We are not a day trader investor. The other part which is important to us is building a resilient portfolio that can withstand market dislocations, and we have demonstrated the resiliency of our portfolio over the years. During the bull market, we may not be at the top in performance, but, hopefully, at the low of the market, our portfolio will be able to withstand better.

Our portfolio is never static. We always reshape it because the environment always changes. Just take for example, interest rates. We never anticipated that the interest rate would hike up so quickly, globally. It caught many investors by surprise – us included. But we believe that while some parts of our portfolio got impacted, other parts of the portfolio also benefitted. So, creating a portfolio that is resilient is equally as important when looking at our TSR. We have to accept the annual fluctuation in the numbers. I can attest to the fact that when we had a 25% return three years ago, we did not spend a second celebrating because it is not that important. What is important is the underlying assets, whether or not the performance can continue into the future.

PNG CHIN YEE: Just to answer the second part of your question, these are obviously historical returns. The NIR framework actually looks at expected long-term real returns, so the Government can spend up to 50% of the expected long-term real returns from the three investment agencies - ourselves, GIC, as well as MAS, and it will be based on the portfolio that each agency has, with a forward-looking view of returns. So that is really how the NIR framework is constructed.

CHIA SONG HWEE: Connie, would you like to illustrate the point about portfolio construction?

CONNIE CHAN: What Song Hwee said about resilience and portfolio construction is exactly where we are focused – building a resilient portfolio across cycles. To give you an example, in financial services. Over the years, we have increased our investments into non-banking sectors. If you looked at our portfolio 10 years ago, it was primarily all banks, and now that mix is more like 50-50. How we have been investing is really based on a thematic approach and thinking about which sectors are benefitting from long-term secular trends; for example, like digitisation or longer lifespans. With that, we increased our exposure to areas like digital payments, to asset management, to market infrastructure and financial software. A lot of these are tied to the digitisation theme and many of these opportunities are in the US as well as Europe. And on the back of longer lifespans, there is also the rising affluence theme in the emerging markets where we have also increased our exposure to insurance.

This diversification, both from a sector as well as a market perspective, has really increased the resilience of our portfolio across market cycles. It has also provided an uplift to our returns. This is just an example of what we have been doing in financial services – this reshaping is representative of what we are doing across our entire portfolio.

CHIA SONG HWEE: Adding to that, as Alpin alluded to earlier, because of the high interest rate, the cap rate has risen and, therefore, many real estate companies globally had to take a revaluation hit on their performance. That has also happened to our portfolio companies. On the other hand, we do own financial institutions like DBS, Standard Chartered bank, and so on, which have benefitted from a higher interest rate environment as they could generate more income from that. That gave us the offset in our portfolio which has given us that resiliency, so to speak.

First, please LoginComment After ~