Global situation of undertakings for collective investment at the end of July 2024

I. Overall situation

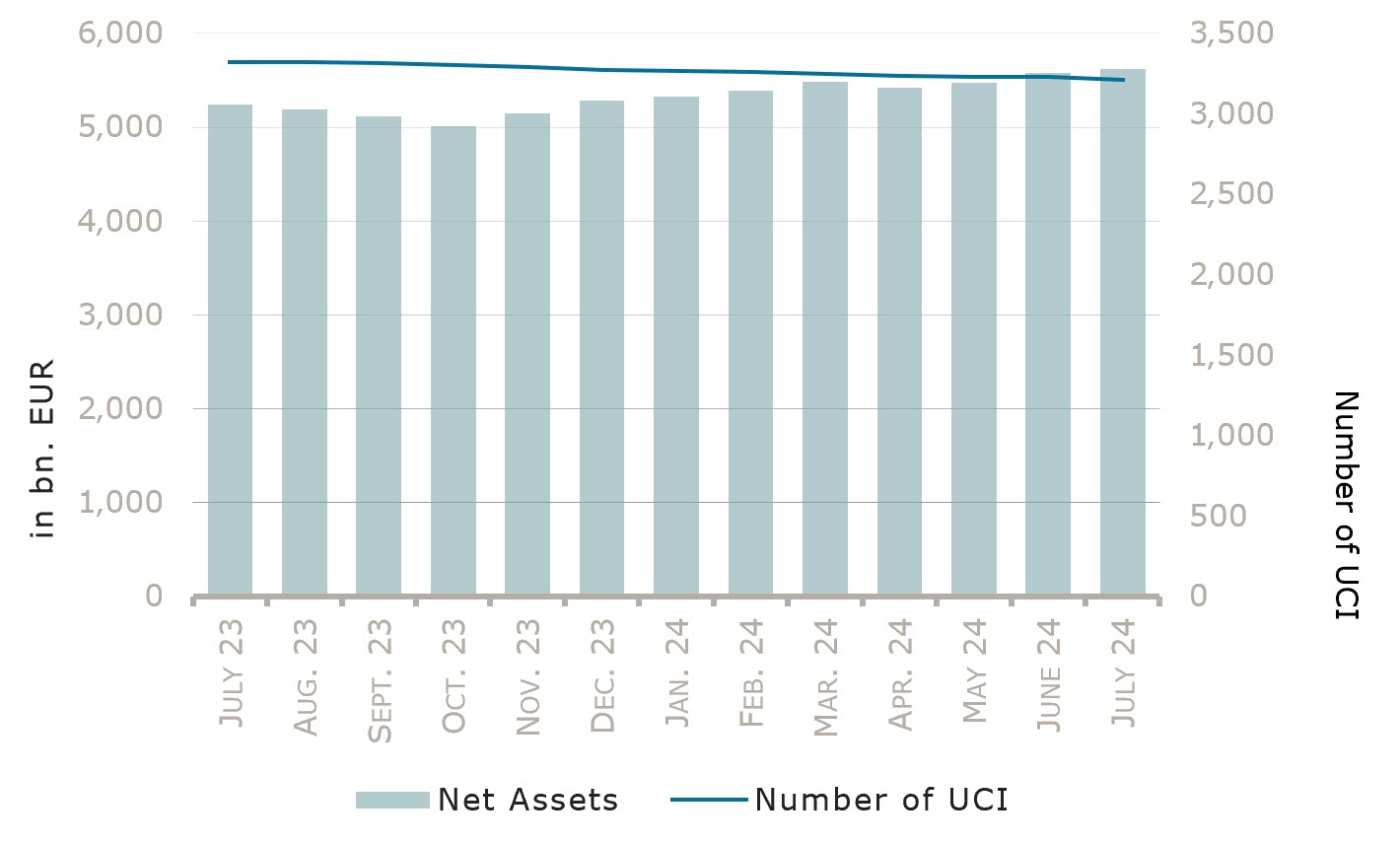

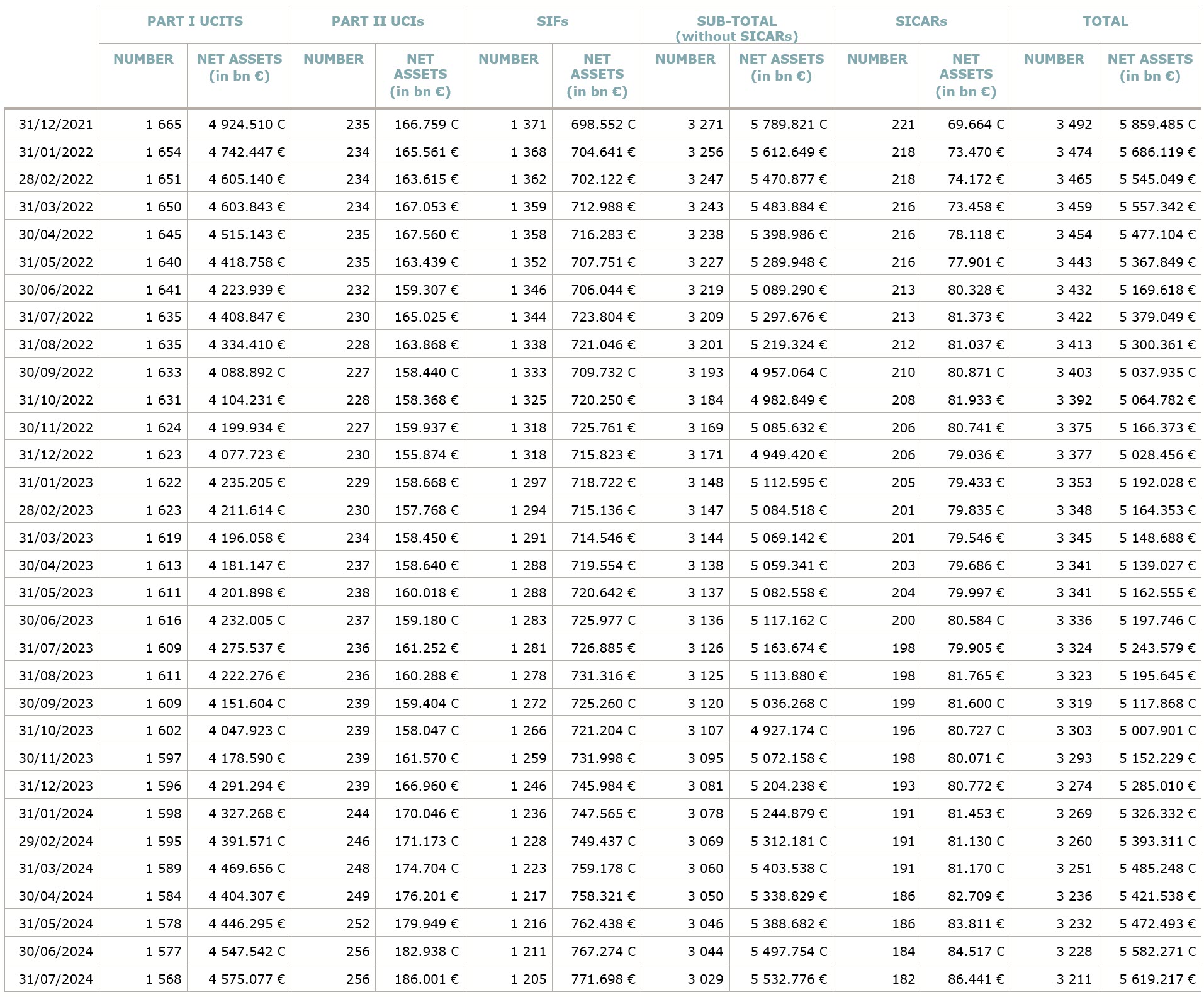

As at 31 July 2024, the total net assets of undertakings for collective investment, comprising UCIs subject to the 2010 Law, specialised investment funds and SICARs, amounted to EUR 5,619.217 billion compared to EUR 5,582.271 billion as at 30 June 2024, i.e. an increase of 0.66% over one month. Over the last twelve months, the volume of net assets increased by 7.16%.

The Luxembourg UCI industry thus registered a positive variation amounting to EUR 36.946 billion in July. This increase represents the sum of positive net capital investments of EUR 12.450 billion (+0.22%) and of the positive development of financial markets amounting to EUR 24.496 billion (+0.44%).

The development of undertakings for collective investment is as follows:

The number of undertakings for collective investment taken into consideration totalled 3,211, against 3,228 the previous month. A total of 2,102 entities adopted an umbrella structure representing 12,670 sub-funds. Adding the 1,109 entities with a traditional UCI structure to that figure, a total of 13,779 fund units were active in the financial centre.

As regards the impact of financial markets on the main categories of undertakings for collective investment and the net capital investment in these UCIs, the following can be said for the month of July.

A series of economic indicators were published during the month, which notably pointed to a weaker-than-expected US labour market, raising concerns on the resilience of the US economy and in turn resulting in increased anticipations of monetary easing by the Fed, including a first rate cut at its September meeting.

In that context, equity markets delivered limited returns, mostly supported by small caps (which are considered to benefit more from interest rate cuts) and, contrary to previous months, dragged down by technology stocks, due to disappointing quarterly earnings and to doubts on the growth potential from IA. The largest monthly performance in euro was delivered by Japanese equities thanks to a currency effect, with a rebound by more than 5% of the yen against the euro. It followed an intervention by the Bank of Japan, as well as expectations of a normalisation of its monetary policy, which materialised at its meeting on 31 July with an increase in the reference rate by 15bps and the announcement of a quantitative tightening plan.

In July, equity UCI categories registered an overall negative capital investment, with limited inflows only for the categories US and Eastern European equities.

Development of equity UCIs during the month of July 2024*

|

Market variation in % |

Net issues in % | |

| Global market equities |

0.19% |

-0.17% |

| European equities |

1.07% |

-0.59% |

| US equities |

-0.49% |

0.46% |

| Japanese equities |

3.72% |

-1.50% |

| Eastern European equities |

-0.59% |

0.21% |

| Asian equities |

-1.55% |

-1.24% |

| Latin American equities |

-0.70% |

-1.80% |

| Other equities |

-0.45% |

-0.12% |

* Variation in % of Net Assets in EUR as compared to the previous month

Against the economic backdrop described above, yields decreased during the month, resulting in gains for all the major bond UCI categories, also supported by a slight decline in credit spreads. USD money market is the sole category to report losses, due to the depreciation of the US dollar against the euro.

In July, fixed income UCIs registered an overall positive net capital investment. The largest inflows were reported by Global money market whereas USD money market reported the only significant – although limited – outflows.

Development of fixed income UCIs during the month of July 2024*

|

Market variation in % |

Net issues in % | |

| EUR money market |

0.30% |

1.61% |

| USD money market |

-1.02% |

-0.46% |

| Global money market |

0.16% |

3.68% |

| EUR-denominated bonds |

1.65% |

0.54% |

| USD-denominated bonds |

1.16% |

1.24% |

| Global market bonds |

1.35% |

0.84% |

| Emerging market bonds |

1.02% |

-0.03% |

| High Yield bonds |

0.78% |

-0.06% |

| Others |

0.96% |

1.07% |

* Variation in % of Net Assets in EUR as compared to the previous month

The development of net assets of diversified Luxembourg UCIs and funds of funds is illustrated in the table below:

Development of diversified UCIs and funds of funds during the month of July 2024*

|

Market variation in % |

Net issues in % | |

| Diversified UCIs |

0.48% |

0.03% |

| Funds of funds |

0.11% |

0.47% |

* Variation in % of Net Assets in EUR as compared to the previous month

II. Breakdown of the number and net assets of UCIs

During the month under review, the following six undertakings for collective investment have been registered on the official list:

UCITS Part I 2010 Law:

- DEKA-CONVERGENCEAKTIEN II, 6, rue Lou Hemmer, L-1748 Senningerberg

UCIs Part II 2010 Law:

- CABOT S.A. SICAV, 12E, rue Guillaume Kroll, L-1882 Luxembourg

- PARTNERS CAPITAL ALTERNATIVE ASSET MANAGEMENT FUND SICAV, 3, rue Jean Piret, L-2350 Luxembourg

SIFs:

- CIF IV CO-INVESTMENT SCA SICAV-SIF, 5, allée Scheffer, L-2520 Luxembourg

- EXPRESS BAYERN, 6, rue Gabriel Lippmann, L-5365 Munsbach

- UBS (LUX) INFRASTRUCTURE CO-INVEST SCSP SICAV-SIF, 15, boulevard F.W. Raiffeisen, L-2411 Luxembourg

The following twenty-three undertakings for collective investment have been deregistered from the official list during the month under review:

UCITS Part I 2010 Law:

- ABSALON, 15, rue de Flaxweiler, L-6776 Grevenmacher

- AISM GLOBAL OPPORTUNITIES FUND, 21, rue Aldringen, L-1118 Luxembourg

- DEKALUX-BIOTECH, 6, rue Lou Hemmer, L-1748 Senningerberg

- DEKA-TREASURY, 6, rue Lou Hemmer, L-1748 Senningerberg

- K & C AKTIENFONDS, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- LUX-BOND, 1, place de Metz, L-1930 Luxembourg

- LUX-CASH, 2, place de Metz, L-1930 Luxembourg

- LUX-CROISSANCE, 1, place de Metz, L-1930 Luxembourg

- LUX-EQUITY, 1, place de Metz, L-1930 Luxembourg

- UNIPROFIANLAGE (2024), 3, Heienhaff, L-1736 Senningerberg

UCIs Part II 2010 Law:

- DWS EMERGING SOVEREIGN BOND FUND USD (AUD), 2, boulevard Konrad Adenauer, L-1115 Luxembourg

- UBP MONEY MARKET FUND, 287-289, route d’Arlon, L-1150 Luxembourg

SIFs:

- ASSENAGON VPF, 1B, Heienhaff, L-1736 Senningerberg

- FLEXIBLE FIVE SICAV-SIF, 16, boulevard Royal, L-2449 Luxembourg

- GLOBAL INVESTMENT OPPORTUNITIES, 88, Grand-rue, L-1660 Luxembourg

- GREENFINCH GLOBAL INVEST FUND, S.C.A, SICAV-FIS, 7b, rue de Bitbourg, L-1273 Luxembourg

- HAHN FCP-FIS, 9A, rue Gabriel Lippmann, L-5365 Munsbach

- LORAC INVESTMENT FUND, 2, rue Hildegard von Bingen, L-1282 Luxembourg

- SUSTAINABLE GROWTH FUND, SCSP, SICAV-SIF, 15, boulevard Friedrich Wilhelm Raiffeisen, L-2411 Luxembourg

- USS FUND SERIES S.C.A. SICAV-FIS, 49, boulevard Royal, L-2449 Luxembourg

- WGZ-ED, 4, rue Thomas Edison, L-1445 Strassen

SICARs:

- MIR CAPITAL S.C.A., SICAR, 28, boulevard de Kockelscheuer, L-1821 Luxembourg

- SILVERSTREET PRIVATE EQUITY STRATEGIES, 412F, route d’Esch, L-1471 Luxembourg

First, please LoginComment After ~