Integrating Climate Adaptation into Physical Risk Models

This report was co-authored by Wong De Rui, Senior Vice President, Sustainability Office, GIC; Kim Kee Bum, Assistant Vice President, Sustainability Office, GIC; Rick Lord, Head of Climate Methodology, S&P Global Sustainable1; Kuntal Singh, Manager, Climate Methodology, S&P Global Sustainable1; Nina Khalili, Senior Scientific Analyst for Climate Risk, S&P Global Sustainable1; Rohini Samtani, Director, Sustainability Sales, S&P Global Market Intelligence; and Tory Grieves, Director, Strategic Initiatives, S&P Global Sustainable1.

The authors would like to thank Emily Chew, Han Hwee Chin, Stephane Mangeon, Charis Tay, Trang Chu Minh and Isabelle Lim from GIC, and Lindsey Hall, Matt MacFarland, Esther Whieldon, Emily Pauline, Rebecca Pu and Anisha Bafna from S&P Global Sustainable1 for their contributions to this report.

Executive Summary

The impacts of climate change are already beginning to materialise into financial risks. According to the World Meteorological Organization (WMO), climate change-related events over the past five decades have resulted in US$4.3 trillion in reported economic losses.

In this report, GIC and S&P Global Sustainable1 analyse the projected increase in physical climate hazards for global real estate properties held by companies in the S&P Global REIT Index

and highlight the following takeaways:

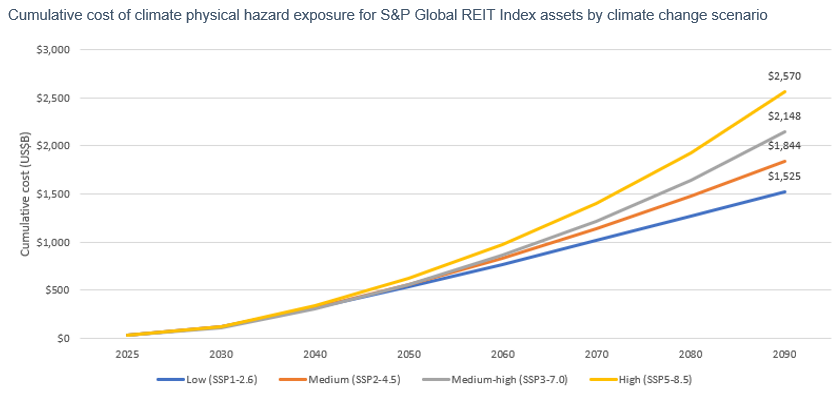

Physical risks have tangible impacts on real assets. Cumulative projected costs of changing climate physical risk exposure could reach US$536 billion, or 26% of the total real estate asset value of the index, by 2050 under the low (SSP1-2.6) climate change scenario. Under a medium-high climate change scenario (SSP3-7.0), the projected cumulative exposure could reach US$559bn, or 28% of the total real estate asset value of the index, by 2050. As we move beyond mid-century, future climate change scenarios diverge sharply, with climate physical risks becoming significantly more onerous in high warming scenarios compared to low warming scenarios. Regardless of the climate scenario used, the warming that is already embedded in the climate system means that physical risks are likely to increase over time, raising costs across the broader economy for customers, tenants, building operators, owners, and investors.

Existing risk assessment models often overlook the impact of adaptation, offering an incomplete picture of actual investment risks from climate events. This omission can lead to an incomplete view of the net costs of physical risks and create challenges for investors in prioritising risk management efforts.

Climate change creates opportunities for adaptation solution providers and for asset owners to invest in adaptation. Our study examines some readily available climate adaptation solutions for non-residential real estate, such as green or cool roofs and wet or dry floodproofing, and estimates the annual demand for these solutions to reach approximately US$29bn globally through 2050 (or US$726bn in total). Coupled with strong policy support and timely deployment, these solutions could reduce the costs of climate physical risks. Wet and dry floodproofing, for example, could offset physical hazard costs by US$3.55 for every US$1 invested.

Introduction

Floods, hurricanes, cyclones, heatwaves, wildfires, rising sea levels, and erratic rainfall are increasing with climate change. In April 2024, a normally dry Dubai experienced 12 months’ worth of rain in 12 hours,

the heaviest rainfall in 75 years, causing almost US$1bn in damages in one day. Globally, the WMO estimates that climate change-induced events have resulted in US$4.3tn in financial losses over the last 50 years.

While these losses are not fully borne by investors and property owners, their indirect impact materialises through damages across the broader economic system. The effects of climate change are increasingly felt here and now, with a tangible impact on the real economy and the value of assets.

However, investors struggle to quantify the financial impact of climate physical risks on their assets. In recent years, climate-related physical risk analytics have proliferated in the financial industry, from providing physical risk scores of locations to estimating valuation impacts on assets.

A key gap in these analytical models is the absence of adaptation measures that can mitigate the impact of the physical risk event, especially if the asset owner is proactive in implementing physical adaptation measures. When screening a portfolio of assets for physical risks, overlooking adaptation may also lead to inaccurate conclusions about the ranking of risky assets in one’s portfolio and divert attention from where investors most need to focus.

With this publication, GIC and S&P Global Sustainable1 aim to advance the financial industry’s approach to climate risk assessments by considering how adaptation analysis alters an assessment of physical risks for assets in the S&P Global REIT Index. Rather than focusing on downside risks alone, we also explore the potential upside opportunities associated with select climate adaptation solutions.

While the scope of the analysis is limited to readily accessible adaptation solutions for building operators, owners, and investors, we acknowledge that adaptation can also occur through government investments in public infrastructure, technological innovation, and behavioural shifts. Further research is needed across the financial industry to incorporate these variables into physical risk assessments.

Coordinated efforts by private and public sector actors will be needed to avoid the worst impacts of climate change. This analysis focuses on a selection of adaptations that are readily available to business owners and investors and which can deliver substantial cost reductions, but it also demonstrates that building-scale adaptations are likely not enough to avoid the worst costs of climate physical risk. Cumulative net benefits of the four adaptation measures studied in this paper (accounting for costs of implementation) are projected to total US$45bn by 2050 under the medium-high scenario, and while substantial in absolute terms, this represents just 8% of the total projected cumulative costs of climate hazard exposure. A coordinated approach combining private sector investments in building-scale adaptation and public investments in large-scale adaptation projects (such as sea walls, levees and other adaptations) will be needed to maximise the protection of communities, assets, and economies.

Section I: Analysis Overview

Climate-related events and hazards are growing in severity, duration, and frequency, posing risks to the assets and operations of companies worldwide.

These risks are likely to worsen as the world warms further due to climate change. Three important pathways through which climate hazards can create direct costs for asset owners and investors include:

- Loss of revenue due to business interruption;

- Excess operating expenses (opex) such as higher cooling costs and productivity impacts;

- And higher capital expenditure (capex) associated with cleanup and repair, accelerated asset degradation, and asset replacement.

In this study, we assess the physical risk impacts across these three dimensions and examine the risk reduction potential of select adaptation measures for real estate assets owned by S&P Global REIT Index constituents. Our analysis is based on a medium-high climate change scenario, which references the Intergovernmental Panel on Climate Change (IPCC)’s SSP3-7.0 climate change scenario. In the medium-high scenario, global warming levels are ultimately higher than the future projected temperature currently implied by Nationally Determined Contributions (NDCs). We believe it is reasonable to select this scenario as the latest UN Emissions Gap Report

concludes that the NDCs are unlikely to be met by current national policies. Nonetheless, we acknowledge that the assumption that climate policies do not materially strengthen over time may be debateable.

Section II: Impact of Physical Climate Hazards on Real Assets

Our analysis suggests that under a medium-high warming scenario without adaptation investment, properties represented in the S&P Global REIT Index could incur US$110bn by 2030, US$310bn by 2040, and US$559bn by 2050 in cumulative excess costs from climate hazard exposure. This implies that by 2050, the cumulative costs (nominal prices) of physical climate risks could reach the equivalent of 28% of the total real estate asset value of the index constituents as of July 2024. The actual costs of physical risks may not directly translate into valuation impairments, as not all costs are borne directly by investors or property owners. However, the data highlights the value of incorporating physical risks into investment processes, as damages can spread across the broader economic system. Importantly, physical risks are estimated to drive financial impacts across all climate scenarios, whereby cumulative projected costs reach US$536bn to US$559bn, or 26% to 28% of the total real estate asset value of the index, by 2050 under the low (SSP1-2.6) and medium-high (SSP3-7.0) scenarios, respectively. For more details, please see Figure 1.

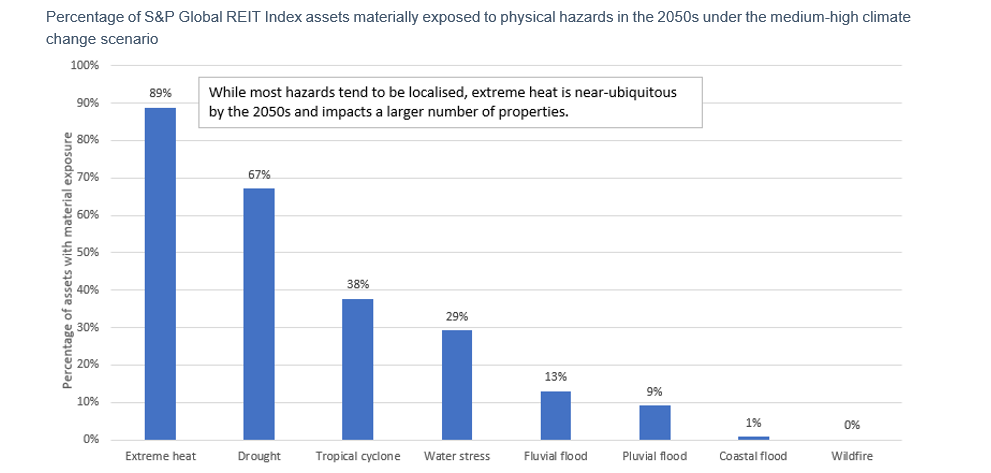

Some hazards, such as extreme heat, will be more widespread across regions, while others, such as tropical cyclones and flood, are more limited to certain regions and geographic conditions. We estimate that 89% of S&P REIT Index constituent assets will be materially exposed to extreme heat by the 2050s, whereas only 1%, 9%, and 13% of assets will be exposed to coastal flood, pluvial flood, and fluvial flood, respectively. Managing physical risks will require investors to take a bottom-up approach to account for the different exposures each property can have to different hazards. Additionally, the skills required to implement the adaptation measures that address more widespread physical impacts may need to become core to real asset management. For further details on our calculation methodology, please see the Appendix.

Figure 1: Cumulative costs of physical hazard exposure are significant even under a low climate change scenario

Source: S&P Global Sustainable1, S&P Global Market Intelligence, 8 August 2024

Figure 2: Real estate asset exposure varies widely by physical hazard

Source: S&P Global Sustainable1, S&P Global Market Intelligence, 8 August 2024

Section III: The Financial Benefits of Investing in Adaptation

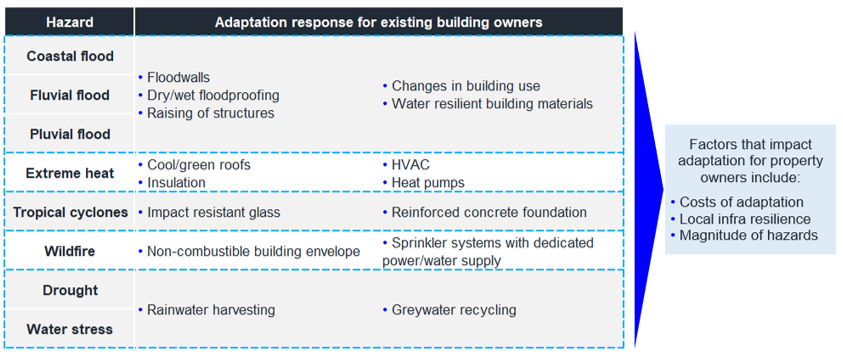

Property owners or managers could better manage the increasing financial impacts from climate change by incorporating adaptation measures into their asset valuation and maintenance work. While climate adaptation measures may take various forms, including government investments into public infrastructure, technological innovation, and behavioural change, we identify a subset of readily available solutions to investors and real asset owners that can be implemented at the property level. These include green or cool roofs to adapt to extreme heat and wet or dry floodproofing solutions to manage flooding risks.

The projected increase in physical hazards worldwide over the next 25 years presents an opportunity for property owners to invest in adaptation measures where benefits outweigh implementation costs. We find that implementing these measures for assets represented in the S&P Global REIT Index could reduce the cumulative cost of climate hazard risks by $45bn on a net basis by 2050, including the cost to deploy the adaptation solutions. This includes reducing the cost of coastal, fluvial, and pluvial flood events by an average of 59% and the cost of extreme heat by 5% compared a scenario with no adaptation measures. If implemented in a timely manner, wet and dry floodproofing could save US$3.55 for every US$1 invested, while green and cool roofs could save US$7.45 for every US$1 invested. From a bottom-up perspective, the relationship between the costs and benefits of deploying various adaptation solutions will vary by asset, depending on their overall commercial viability and the intensity of relevant climate hazards. Below, we provide a non-exhaustive list of solutions that property owners and investors can deploy, assuming these solutions are economical.

While the total benefits of green and cool roof and wet and dry floodproofing adaptations are large and the return on each dollar invested is high, these selected adaptation measures alone are not able to eliminate the majority of the projected costs of climate hazard exposures leading up to 2050. This is due to several reasons. This study does not consider adaptations for other hazards such as wildfire, tropical cyclone, drought, and water stress, and both wet and dry floodproofing adaptations can only reduce, but not fully eliminate, the costs associated with flood events. The impact of flooding could be further reduced through broader infrastructure investments by governments to prevent flood waters from reaching properties, such as sea walls, levees, drainage, and other flood mitigation infrastructure. Furthermore, while green and cool roofs can reduce cooling costs and HVAC degradation caused by extreme heat, these adaptations do not address the largest driver of the cost of extreme heat — impacts on employee productivity and wellbeing. There is room for more ambitious action by governments on climate adaptation at the local, regional, and national scale, in addition to investors’ own bottom-up investments in property-level adaptation.

We also note that rising physical risks offer an opportunity for companies that provide solutions to help the world adapt to a new environment. We estimate global non-residential demand for green or cool roofs and floodproofing adaptation measures could present a US$726bn revenue opportunity through 2050, or about US$29bn each year under a medium-high warming scenario.

For a more detailed description of extreme heat and floodproofing adaptation measures, as well as our calculation methodology, please see the Appendix.

Figure 3: Examples of adaptation measures that building owners can implement

Source: UN, US FEMA, US EPA, S&P Global Sustainable1, S&P Global Market Intelligence and GIC

Conclusion

The effects of climate change are already translating into financial losses for real estate assets globally. This trend will likely accelerate as the window of opportunity to curb global warming narrows each year. Under a medium-high warming scenario, the cumulative costs (as a % of asset value) arising from physical climate risks could reach 28% of the total real estate asset value held in the S&P Global REIT Index, or US$559bn, by 2050 based on our analysis.

However, adaptation can partially offset these risks in a cost-effective manner, creating opportunities for solution providers. As the focus on adaptation grows, we estimate the annual demand for select adaptation solutions, including non-residential green or cool roofs and wet or dry floodproofing, could reach approximately US$29bn globally through 2050 or US$726bn in cumulative terms. Combined with strong policy support and timely deployment, wet and dry floodproofing could save US$3.55, and green and cool roofs US$7.45, for every US$1 invested in the non-residential real estate sector. These measures only represent a small subset of adaptation solutions, and there are other cost-effective solutions across different industries that governments, investors, and asset owners can leverage to enhance global resilience against climate-related physical risks.

While climate risk assessment models are expanding in scope and sophistication across the financial industry, the lack of adaptation considerations creates challenges in providing holistic datapoints to help investors and asset owners prioritise risk management efforts. Looking ahead, climate-related physical risk assessment models need to evolve to capture a wider category of adaptation solutions. Further work is required to increase the granularity of models on region- and asset-specific marginal adaptation cost curves to produce more actionable insights for investors and asset owners.

In addition, national and local adaptation plans by governments, advancements in new climate adaptation technologies, and behavioural shifts are important areas to consider, as these can materially increase the resilience of real assets against the impacts of climate change.

This report aims to provide an initial analysis to prototype and catalyse the financial industry’s efforts in incorporating adaptation measures into risk assessment models. We invite industry participants to contribute their perspectives on how to enhance existing climate assessment approaches and advance the industry’s response to growing climate-related physical risks.

First, please LoginComment After ~