HKTDC Export Confidence Index 3Q24: Sustained Optimism Underpinned by Strong Sales and New Orders

Key Findings

- The newly-released 3Q24 update to the HKTDC Export Confidence Index shows that Hong Kong exporters remain optimistic, albeit slightly less so than in 2Q24. This suggests the immediate future will be characterised by moderate, sustained growth.

- In more specific terms, the overall Current Performance Index rose by 1 point to 52.6, a development seen as reflecting strong sales and new orders, rising unit prices and expanding procurement activities. This was underlined by concurrent rises in the relevant Sub-Indices – Trade Value Sub-Index (56.2, +2.5) and Procurement Sub-Index (57.3, +3.3). In the case of the Sales & New Orders Sub-Index, although it recorded a moderate 1.8 drop, it stayed resolutely in expansionary territory at 55.7.

- The Expectation Index also remained in expansionary territory at 51.4 despite a 2.9-point dip, an outcome seen as underlining Hong Kong’s resilience amid rising trade tensions. This decrease was driven mainly by the 8.5-point decline in the Trade Value Expectation Sub-Index (down to 51.7), with traders expecting unit prices to increase only moderately after significant price increase for two consecutive quarters. Traders, however, remained optimistic about the outlook for sales and new orders (with a Sales & New Orders Expectation Sub-Index reading of 54.6); and look set to continue to expand their procurement activities (Procurement Expectation Sub-Index: 55.4).

- It was also apparent that costs remained the major drag on exporter confidence in 3Q24. While both the Current and Expectation Cost Sub-Indexes showed some improvement, scores remained at about the 35 level, an indication that exporters are still facing sizable rising cost pressures.

- In more specific terms, the overall Current Performance Index rose by 1 point to 52.6, a development seen as reflecting strong sales and new orders, rising unit prices and expanding procurement activities. This was underlined by concurrent rises in the relevant Sub-Indices – Trade Value Sub-Index (56.2, +2.5) and Procurement Sub-Index (57.3, +3.3). In the case of the Sales & New Orders Sub-Index, although it recorded a moderate 1.8 drop, it stayed resolutely in expansionary territory at 55.7.

- In terms of markets, exporters have seen increased Sales and New Orders across all of their key markets in the current quarter (Current Performance readings of all markets were higher than 50). With regard to outlook (Expectation), exporters were most upbeat about the ASEAN bloc (59.7) and mainland China (58.4).

- By industry, 3Q24 saw an improvement in Current Performance across all sectors. Looking ahead, Clothing exporters are the most optimistic at 61.2, followed by Toys (58.7) and Jewellery (56.4).

- In addition to addressing the standard index criteria, the 3Q24 survey also focussed on a number of specific thematic questions with regard to the primary challenges facing exporters and the favoured forward strategies of participants. Responses here showed that:

- High and rising costs (transport, labour, production and capital) were seen as the most significant challenges.

- In order to mitigate any related risks, Hong Kong exporters intend to adopt more cautionary business strategies.

- When asked about the impact of the recent trade restrictions proposed by several major advanced markets, 60% of respondents reported no impact on their business to date, while 39% expected only mild to moderate downside. In all, just some 1% anticipated significantly negative consequences.

- On the sustainability front, however, fewer than 20% of respondents were familiar with the EU’s newly enacted (18 July, 2024) Ecodesign for Sustainable Products Regulations (ESPR), which is expected to have a broad impact across many industry sectors.

- High and rising costs (transport, labour, production and capital) were seen as the most significant challenges.

Index overview

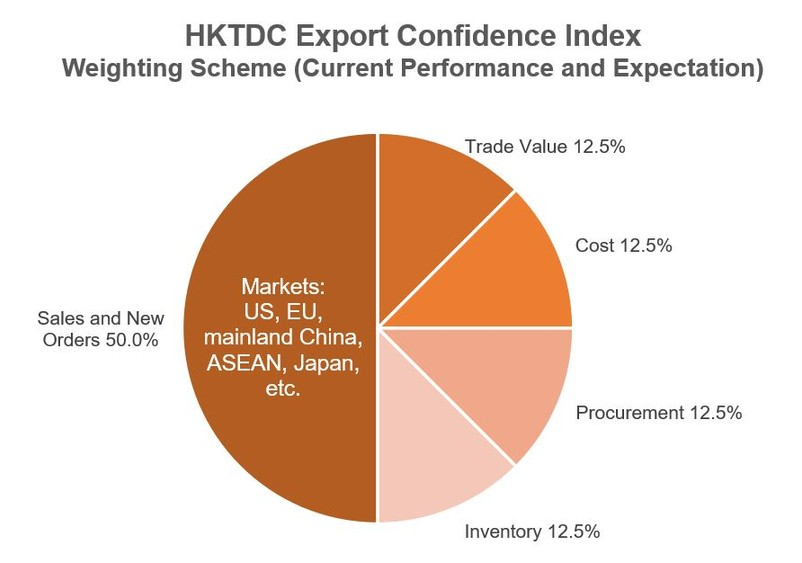

The new HKTDC Export Confidence Index, which debuted at the end of 1Q24, comprises five sub‑indices – (1) Sales and New Orders, (2) Trade Value, (3) Cost, (4) Procurement, and (5) Inventory. All of these are composited in order to deliver a comprehensive evaluation of the business prospects of Hong Kong exporters (see Appendix for more detailed methodology).

For 3Q24, both the Current Performance and Expectation readings of the HKTDC Export Confidence Index remained above the 50 threshold.1 The Current Performance Index rose by 1 point to 52.6, indicating an improvement in current business performance. Meanwhile, the Expectation Index fell 2.9 points to 51.4, indicating business sentiment remains broadly optimistic, albeit a little more subdued than in 2Q24.

Sub-indices

The Sub‑Indices provide a more comprehensive review of the underlying factors impacting exporter confidence.

The improvements in the Current Performance Index have largely been driven by strong sales and new orders, rising unit prices and expanding procurement activities. The respective Sub‑Indices readings were: Sales & New Orders (55.7), Trade Value (56.2) and Procurement (57.3) for 3Q24.

Looking ahead, the Expectation Index shows moderating export confidence underpinned by sustained positivity. For its part, the Expectation Index declined by a moderate 2.9 points to 51.4 in 3Q24, but remained in expansionary territory. The indications are that traders remain optimistic about sales and new orders (with a Sales & New Orders Expectation Sub-Index reading of 54.6); and will continue to expand their procurement activities (Procurement Expectation Sub-Index, 55.4); while expecting unit prices to increase moderately (Trade Value Expectation Sub-Index, 51.7).

Furthermore, traders’ inventories have returned to (and are expected to stay at) a neutral level after higher‑than‑normal inventory levels characterised several previous quarters. Accordingly, the Inventory Sub-Index was at 49.8, while the Expectation Index, reflecting confidence for the coming quarter, held steady at 49.7.

Despite slightly improved readings for both the Current and Expectation Cost Sub-Index, cost pressure continued to negatively impact investor confidence in 3Q24. This resulted in the relevant readings settling at a relatively tepid level of about 35.

HKTDC Export Confidence Index | Current Performance | Expectation | ||

3Q24 | 2Q24 | 3Q24 | 2Q24 | |

Overall | 52.6 | 51.6 | 51.4 | 54.3 |

Sales and New Orders | 55.7 | 57.5 | 54.6 | 59.4 |

Trade Value (unit price) | 56.2 | 53.7 | 51.7 | 60.2 |

Cost (incl. materials, labour, finance & other operation costs)# | 34.8 | 31.8 | 35.9 | 33.0 |

Procurement | 57.3 | 54.0 | 55.4 | 57.2 |

Inventory# | 49.8 | 42.9 | 49.7 | 46.3 |

Note: # The Cost and Inventory sub-indices are inverted. Cost sub-index: A reading above 50 indicates a downward trend on costs, while a reading below 50 indicates an upward trend on costs. Inventory sub-index: A reading above 50 indicates a lower-than-normal inventory level, while a reading below 50 indicates a higher-than-normal inventory level. | ||||

Market outlook2

In terms of Current Performance, exporters reported increased sales and new orders across all markets. In particular, higher‑than‑average scores were recorded for the ASEAN bloc (60.2), mainland China (58.2), others (56.1) and the EU (53.1).

In terms of outlook (or Expectation), exporters remained upbeat about ASEAN (59.7) and mainland China (58.4), while readings for the US, EU and Japan dropped below the 50 level, a possible reflection of the lingering US‑China and US‑EU trade tensions over the past few months.

Current Performance | Expectation | |||

3Q24 | 2Q24 | 3Q24 | 2Q24 | |

Sales and New Orders Sub-Index | 55.7 | 57.5 | 54.6 | 59.4 |

US | 51.5 | 53.6 | 48.5 | 57.1 |

EU | 53.1 | 53.5 | 46.9 | 55.7 |

Mainland China | 58.2 | 60.5 | 58.4 | 62.2 |

ASEAN | 60.2 | 52.7 | 59.7 | 52.8 |

Japan | 52.5 | 47.5 | 46.7 | 51.3 |

Others | 56.1 | 53.1 | 49.2 | 53.9 |

Industry outlook

By industry, all sectors showed some improvements in terms of Current Performance. This uplift in sentiment was most notable for Clothing (up 10 points to 58.9) and Toys (up 6 points to 54.1). Electronics, Jewellery and Equipment/Materials held steady at about a relatively robust 53, while Timepieces rallied slightly from 41.3 to 42.7, although remaining below the neutral 50 level.

Current Performance | Expectation | |||

3Q24 | 2Q24 | 3Q24 | 2Q24 | |

Overall | 52.6 | 51.6 | 51.4 | 54.3 |

Electronics | 52.9 | 52.4 | 51.4 | 55.0 |

Clothing | 58.9 | 48.7 | 61.2 | 48.1 |

Toys | 54.1 | 47.8 | 58.7 | 51.8 |

Jewellery | 52.2 | 52.0 | 56.4 | 53.0 |

Timepieces | 42.7 | 41.3 | 46.3 | 45.3 |

Equipment/materials | 53.0 | 51.0 | 53.2 | 52.5 |

In terms of outlook (or Expectation), Clothing exporters were the most upbeat at 61.2, followed by Toys (58.7) and Jewellery (56.4). In terms of Sales and New Orders, the confidence of Clothing exporters soared to nearly 70, while respondents in the Toys and Jewellery industries also returned scores of above 60. In the case of unit prices (Trade Value), Clothing, Toys and Jewellery exporters all appeared hopeful of substantial price increases. Respondents in these three sectors, however, also expect increased cost pressures.

For their part, Electronics and Equipment/Materials exporters anticipated that Sales and New Orders levels would remain healthy. Those in the Equipment / Materials sector, with a Trade Value Expectation level of 56.9, anticipate that prices will continue to increase strongly amid slightly lessening cost pressures, while Electronics traders expect prices to stabilise.

Electronics | Clothing | Toys | Jewellery | Timepieces | Equipment/ Materials | |||||||

Current | Expect | Current | Expect | Current | Expect | Current | Expect | Current | Expect | Current | Expect | |

HKTDC Export Index | 52.9 | 51.4 | 58.9 | 61.2 | 54.1 | 58.7 | 52.2 | 56.4 | 42.7 | 46.3 | 53.0 | 53.2 |

Sales & New Orders | 56.3 | 55.1 | 67.7 | 69.5 | 56.6 | 66.1 | 56.4 | 60.2 | 41.5 | 45.7 | 55.1 | 55.9 |

Trade Value | 55.8 | 50.7 | 66.4 | 68.0 | 63.7 | 65.7 | 57.4 | 61.5 | 47.1 | 44.1 | 58.8 | 56.9 |

Overall Cost # | 35.3 | 36.0 | 18.9 | 23.8 | 37.3 | 32.4 | 21.3 | 25.4 | 36.3 | 40.2 | 33.1 | 38.1 |

Procurement | 57.4 | 54.9 | 60.7 | 65.6 | 60.8 | 62.7 | 59.8 | 64.8 | 43.1 | 49.0 | 58.8 | 57.5 |

Inventory # | 49.5 | 49.5 | 54.5 | 54.5 | 45.1 | 44.1 | 53.5 | 58.8 | 49.0 | 54.0 | 53.3 | 49.3 |

Note: # The Cost and Inventory sub-indices are inverted. Cost sub-index: A reading above 50 indicates a downward trend on costs, while a reading below 50 indicates an upward trend on costs. Inventory sub-index: A reading above 50 indicates a lower-than-normal inventory level, while a reading below 50 indicates a higher-than-normal inventory level. | ||||||||||||

Thematic Responses

In 3Q24, high / rising costs appeared to be causing the most concern. More specifically, escalating transport cost continued to be seen as the primary challenge, while labour and production costs were now the second (up from fourth in the previous quarter), and high capital costs again ranked third. It is also worth noting that the risk of economic slowdown was one of respondents’ most compelling five concerns this quarter.

Challenges in the coming 12 months

3Q24 | 2Q24 | |

1 | Rising transport costs | Rising transport costs |

2 | Rising labour and production costs | High capital costs |

3 | High capital costs | Exchange-rate fluctuations, currency devaluations in target markets |

4 | Economic slowdown / recession risk in overseas markets resulting in insufficient orders | Rising labour and production costs |

5 | Exchange rate fluctuations, currency devaluations in target markets | US-China trade conflict, Russia-Ukraine / Israel-Palestine conflict |

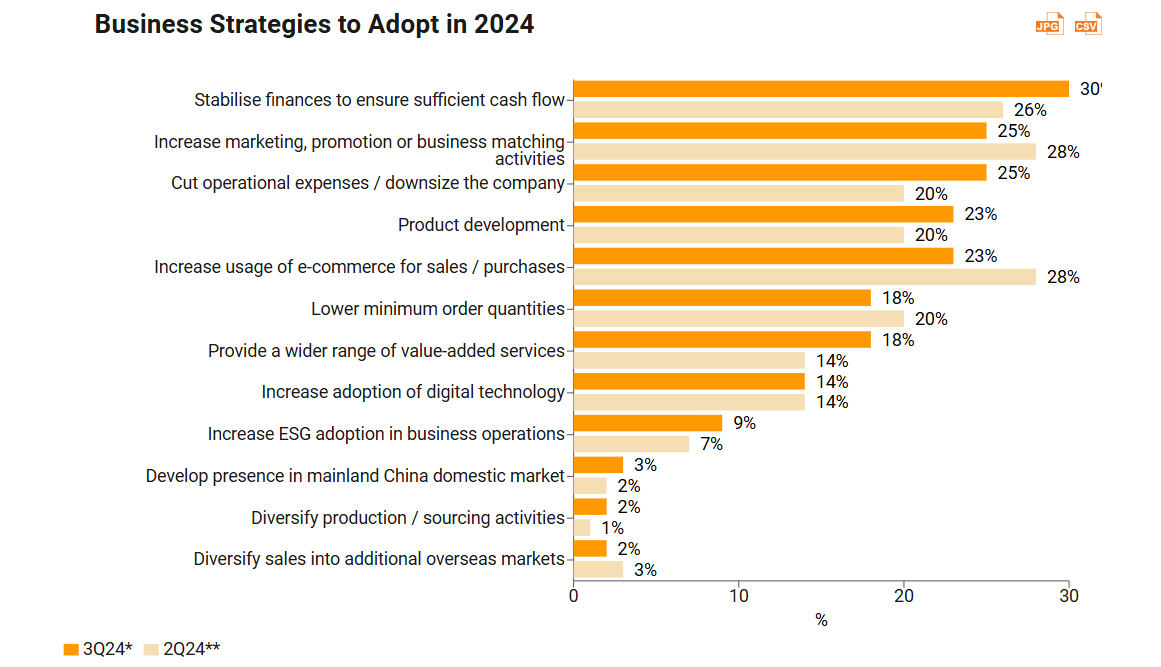

Overall, more exporters are now committed to adopting cautious business strategies. This can be taken as a consequence of high / rising cost pressures, as well as concerns of economic slowdown (and a consequent deceleration of consumer demand) in many overseas markets. In light of this, maintaining financial stability was cited as the primary business strategy of the largest percentage of survey respondents (30%, up four percentage points from 2Q24). Increasing marketing and promotional activity was also deemed a key strategy (25%, down three percentage points), while an increased proportion of respondents also indicated they were prioritising cutting expenses (25%, up five percentage points).

Trade restrictions

Recently, the US, Canada and EU have all proposed stepping up their trade restrictions against China. Among the mooted moves are imposing additional tariffs on electric vehicles, certain semiconductor products, and other products, including minerals, steel and aluminium items.

At present, 60% of respondents indicated that they do not expect to be affected by the proposed tariff increases, while 39% expect only mild to moderate downside. In all, only 1% of respondents anticipated significantly negative consequences.

Impacts of Proposed Trade Restrictions on Hong Kong Exporters’ Trade Business in the Coming Year | ||

Electronics | All Industries | |

Significantly negative impact | 1% | 1% |

Moderate negative impact | 13% | 11% |

Mild negative impact | 36% | 29% |

No impact at all | 50% | 60% |

EU ecodesign regulations

The European Union (EU) is often seen as a first mover in terms of sustainable policies and regulations. Among the most recent istheEcodesign for Sustainable Products Regulation (ESPR), which came into effect from 18 July this year and targets a broad spectrum of environmental concerns beyond energy consumption.3 In light of this, Hong Kong traders were asked to indicate their awareness / understanding of the newESPRregime.

In general, exporters appeared to have little awareness of this newly‑enacted legislation, which is set to have an impact on a multi‑industry basis. This low level of awareness was evident across all sectors, with only 18% of respondents indicating some familiarity (somewhat/moderately/extremely familiar) with theESPRprotocols.

Electronics | Clothing | Toys | Jewellery | Timepieces | Equipment / Materials | All Industries | |

Extremely familiar | 0% | 2% | 0% | 0% | 0% | 0% | 0% |

Moderately familiar | 4% | 0% | 0% | 3% | 0% | 6% | 3% |

Somewhat familiar | 18% | 3% | 8% | 16% | 12% | 25% | 15% |

Not-so-familiar | 52% | 59% | 61% | 52% | 61% | 49% | 54% |

Not familiar | 26% | 36% | 31% | 28% | 27% | 20% | 27% |

Appendix

TheHKTDC Export Confidence Indexwas introduced in 1Q24. It is a composite of five sub-indices –Sales and New Orders,Trade Value,Cost,ProcurementandInventory– and seeks to provide a comprehensive overview of Hong Kong exporter sentiment.

There are two primary / overall indices, one of which gauges the Current Performance in the present quarter, while the other considers the Expectation for the upcoming quarter via the weighted average of the following five sub-indices:

- Sales and New Orders:This is an indication of overall export performance as well as the level of new export orders received by respondents. This index is compiled based on respondents' feedback regarding the prospects of each of their major export markets.

- Trade Value: This focuses on tracking the movement of unit export prices.

- Cost: This tracks cost pressures as they relate to day-to-day operations, including raw material prices / labour and other operational costs/ financing requirements. Compared with the other indices, it is an inverted index, with an index reading above 50 indicating a downward trend for costs, while a reading below 50 indicates an upward trend for costs.

- Procurement: This is a measure of the input-buying activity of Hong Kong traders.

- Inventory: This tracks the overall inventory levels held by respondents for present use and the upcoming quarter. An index reading above 50 indicates a lower-than-normal inventory level, while a reading below 50 indicates a higher-than-normal inventory level.

13Q24 data were collected during 8 – 27 August 2024.

2TheSales and New Orders Sub-Index is compiled from respondents' feedback regarding the prospects for their major export markets.

3The Ecodesign for Sustainable Products Regulation (ESPR), effective as of 18 July, 2024, supersedes the 2009 Ecodesign Directive, widening its focus from energy‑related products to encompass a vast array of goods in the EU market, such as textiles, electronics, plastics, and more. This expansion targets a broader spectrum of environmental impacts beyond energy consumption, reflecting a proactive shift towards more sustainable practices.

The HKTDC Export Confidence Indexis designed to gauge the prospects of the near-term export performance of Hong Kong traders. To deliver on this, a quarterly survey of 500+ Hong Kong traders from six major industry sectors is conducted. Any index reading above 50 indicates an upward trend and an optimistic outlook, while any index reading below 50 indicates a downward trend and a pessimistic outlook.

As this is a new Index, which debuted in 1Q24, its findings cannot be directly compared with those of earlier studies.

First, please LoginComment After ~