GBA – Survey Shows Softer Business Performance

Q3 GBAI indices show softer ‘current performance’; alongside modest rise in ‘expectations’

By component, ‘profits’ saw the biggest q/q fall; by industry, ‘manufacturing’ had the lowest scores

Respondents said ‘surplus cash’, ‘receivables turnover’ worsened, and bank borrowing costs rose

Our thematic questions look into domestic and external risks, and the impact of trade barriers

More policy support likely needed

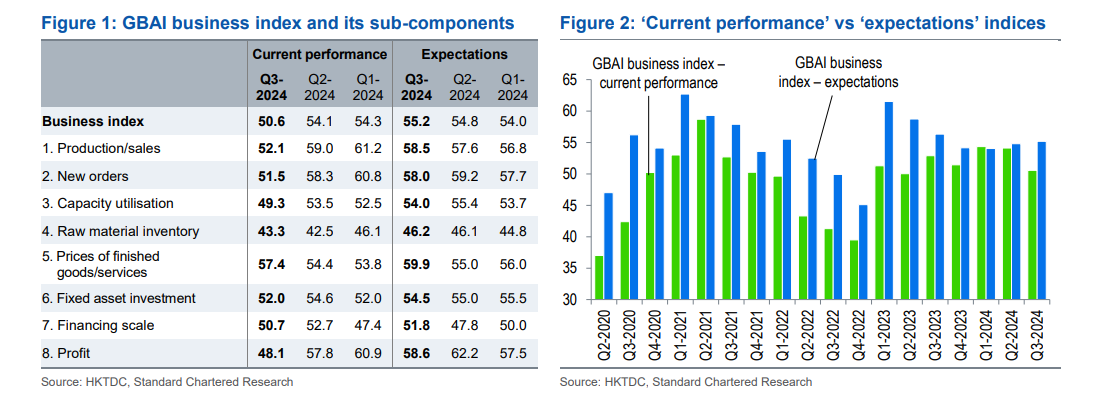

Our GBA Business Confidence Index (GBAI), based on quarterly surveys of over 1,000 companies operating in the Guangdong‑Hong Kong‑Macau Greater Bay Area (GBA) and conducted in collaboration with the Hong Kong Trade Development Council (HKTDC), shows that Q3 business sentiment worsened on balance after remaining largely unchanged in Q2. The headline ‘current performance’ index for business activity fell to 50.6 from 54.1 in Q2, indicating a further weakening of economic momentum after a challenging H1. But the headline ‘expectations’ index of business activity performed better, rising for a second straight quarter to 55.2 from 54.8 in Q2, although we think the improvement was too modest to suggest a quick rebound on the horizon. A further breakdown shows that key components such as ‘profits’, ‘capacity utilisation’ and ‘new orders’ weighed on both the ‘current performance’ and ‘expectations’ indices; by industry, ‘manufacturing’ was the underperformer.

Our GBAI credit indices showed a worsening of current and expected performance of surplus cash and receivables turnover; the rise in market rate cut expectations prior to and during our survey period also failed to improve our survey respondents’ expectations of cheaper bank borrowing or easier access to bank credit. Responses to our thematic questions reflect the need for more policy support to help GBA companies address their domestic and external challenges. We think more sizeable monetary policy easing recently in both the US and China will provide some much needed relief for GBA companies, creating a floor for our GBAI in the coming quarter.

Please click to read the full report.

First, please LoginComment After ~