Driving the electronification of FX futures

ESAs publish 2024 Joint Report on principal adverse impacts disclosures under the Sustainable Finance Disclosure Regulation

The digital euro: what's in it for you?

Eurex Clearing successfully participates in ECB trials for wholesale digital money pilot

The EBA clarifies the procedure for the classification of asset referenced tokens and e-money tokens as significant and the transfer of supervisory powers between the EBA and competent authorities

Euronext rings the bell to support financial literacy and mark World Investor Week

Join IPO ready 2025: Euronext's pre-IPO training programme now accepting applications

Net interest margin of EU/EEA banks slightly decreased on a quarterly basis

The European Banking Authority (EBA) today published its Q2 2024 quarterly Risk Dashboard (RDB), whi

Successful expansion of Euronext Clearing to all Euronext financial derivatives markets

ESAs warn of risks from economic and geopolitical events

Introducing the ESG Reporting Guide 2024: Euronext's ultimate guide to sustainability reporting

The euro area inflation outlook: a scenario analysis

Markets increasingly sensitive after strong performance in early 2024

Monetary developments in the euro area: July 2024

Kosovo central bank hails ‘significant step forward’ in digital finance push

The governor of the Kosovo’s central bank has hailed a newly signed co-operation agreement with the

ESMA publishes translations of its Guidelines on funds' names

The EBA publishes final draft technical standards on market risk as part of its roadmap for the implementation of the Banking Package in the EU

ECB harmonises rules for Eurosystem collateral management

Reducing latency in stock exchange order data transmission via wireless microwave networks

The EBA and ECB release a joint report on payment fraud

ESAs published second batch of policy products under DORA

Survey on the Access to Finance of Enterprises: moderate tightening in reported financing conditions

ESAs consult on Guidelines under the Markets in Crypto-Assets Regulation

Euronext boosts global debt listing leadership with updated GEM Debt Rulebook and the launch of an innovative harmonised digital listing solution, MyEuronext Portal

The EBA starts dialogue with the banking industry on 2025 EU-Wide stress test methodology

New MiCA rules increase transparency for retail investors

EBA and ESMA publish guidelines on suitability of management body members and shareholders for entities under MiCAR

The EBA updates the Pillar 3 disclosure framework finalising the implementation of the Basel III Pillar 3 framework

Completing banking union and capital markets union is crucial, ECB report shows

Consultation on European Green Bond Regulation

ECB appoints three new Supervisory Board members

ESAs publish templates and tools for voluntary dry run exercise to support the DORA implementation

Euronext Blue Challenge 2024 Final: Sustainable solutions take centre stage

ESMA makes recommendations for more effective and attractive capital markets in the EU

Financial stability vulnerabilities have eased but the outlook remains fragile, ECB finds

The EBA publishes final draft technical standards under the Markets in Crypto-Assets Regulation

ESMA publishes latest edition of its newsletter

The analytics of the monetary policy tightening cycle

The EBA presents its main achievement in 2023

ESAs risk update: risks remain high in the EU financial system

Euro area economic and financial developments by institutional sector: fourth quarter of 2023

ESMA shows EU regulators' supervisory practices regarding EMIR data quality improving

Successful launch of Euronext Mid-Point Match offering dark, mid-point and sweep functionalities

ESMA publishes first overview of EU securities financing transactions markets

Denmark joins T2 and TIPS to fully integrate Danish krone in Eurosystem’s payment services

ECB announces changes to the operational framework for implementing monetary policy

The EBA publishes final draft technical standards on complaints handling for issuers of asset referenced tokens

Euronext's commitment to gender equality: Building a better future

Statement by the ECB Governing Council on advancing the Capital Markets Union

ELITE launches its second group of leading companies in Portugal, growing Euronext’s large private market ecosystem

ESMA publishes the results of the annual transparency calculations for equity and equity-like instruments

CAC 40 Index Daily Options

Financial statements of the ECB for 2023

ESMA withdraws Euronext authorisation as a data reporting service provider under MIFIR upon the entity's request

Euronext publishes Q4 and full year 2023 results

Requirements when posting investments recommendations on social media

The EBA seeks inputs from credit institutions on the classification methodologies for exposures to ESG risks

ESMA consults on reverse solicitation and classification of crypto assets as financial instruments under MiCA

Market infrastructure and payments explained

Euronext launches the largest and most diverse IPOready edition to date

ESAs publish first set of rules under DORA for ICT and third-party risk management and incident classification

The EBA responds to law firm on the prudential treatment of a BNP Paribas legacy instrument

ESMA explores risk exposures to real estate in EU securities markets and investment funds

The European Securities and Markets Authority (ESMA), the EU's financial markets regulator and supervisor

Full year and December 2023 figures at Eurex

ECB Monetary developments in the euro area: November 2023

The EBA consults on Guidelines on internal policies, procedures and controls to ensure the implementation of Union and national sanctions

Euronext's 2023 IPOs and listing achievements

Decisions taken by the Governing Council of the ECB (in addition to decisions setting interest rates)

ESMA to launch and participate in Common Supervisory Action on ESG disclosures for Benchmarks Administrators

ESAs recommend steps to improve activities of innovation facilitators across the European Economic Area

ESMA highlights potential conflicts of interest risks in changes to Collateralised Loan Obligation rating methodologies

Euronext expands clearing operations: a step towards a unified European financial landscape

EBA issues guidance to AML/CFT supervisors of CASPs - European Banking Authority

The EBA publishes final templates to collect climate-related data from EU banks

ESAs publish amended technical standards on the mapping of External Credit Assessment Institutions - European Banking Authority

Euronext publishes Q3 2023 results

ECB publishes consolidated banking data for end-June 2023

EBA releases the technical package for phase 3 of its 3.3 reporting framework

European Supervisory Authorities publish joint criteria on the independence of supervisory authorities

ECB:Monetary developments in the euro area: September 2023

Eurosystem proceeds to next phase of digital euro project

ESMA encourages preparations for a smooth transition to MiCA

ESMA extends temporary CCP collateral emergency measures by six months

ECB Consumer Expectations Survey results – August 2023

The EBA publishes 2023 list of third country groups and third country branches operating in the EU/EEA

ESMA provides analysis on issuers' potential benefits from an ESG pricing effect

The European Securities and Markets Authority (ESMA), the EU's financial markets and securities regulator, today publishes an article on the European sustainable debt market, analysing the existence of an ESG pricing effect (‘the Greenium’) across different types of sustainable-labelled debt instruments.

EBA launches 2023 EU-wide transparency exercise

ESAs warn of risks resulting from a fragile economic outlook

The EBA responds to the EU Parliament's 2021 Discharge Report

Faster green transition would benefit firms, households and banks, ECB economy-wide climate stress test finds

"We need more decisive policies to ensure a speedier transition towards a net-zero economy"

Goldman Sachs supports listed FX business at Eurex

- Goldman Sachs supporting listed FX as Clearing Member and Liquidity Provider - Major milestone for Eurex's FX liquidity hub

Euronext launches innovative ESG solutions to accelerate the transition towards sustainable finance, during the first Euronext Sustainability Week

Euronext Sustainability Week, the flagship pan-European event for sustainable finance

ESMA seeks experts for new Consultative Working Groups under its Risk Committee

Eurex to launch Daily Options

Eurex extends its diversified equity index product suite by listing Daily Options.

Supervisory cooperation in the fight against financial crime is improving, the EBA finds - European Banking Authority

The European Banking Authority (EBA) published its third Report on the functioning of anti-money laundering and countering the financing of terrorism (AML/CFT) colleges.

Consolidated financial statement of the Eurosystem

4 August 2023

The EBA is collecting bank data on interest rate risk in the banking book

The EBA will collect on an ad-hoc basis interest rate risk in the banking book (IRRBB) data from the institutions already participating in the quantitative impact study (QIS) exercise and based on the templates from the final draft Implementing Technical Standards (ITS) on IRRBB reporting.

The EBA updates guidance on reporting of Financial Soundness Indicators to the International Monetary Fund

This update takes stock of the additional experience gathered by the EBA with available data after the publication of the latest IMF FSI Guide in 2019.

Monetary policy decisions

The Governing Council decided to raise the three key ECB interest rates by 25 basis points.

Euronext makes TradeLog, its employee trading monitoring tool, available to companies across Europe Back

Euronext today announces that TradeLog, its online software which allows companies to monitor and automate pre-clearance for employees' personal trading, is now available to companies across Europe, after its successful launch in Denmark and Norway.

The EBA updates on the monitoring of Additional Tier 1, Tier 2 and TLAC/MREL eligible liabilities instruments of European Union institutions

The European Banking Authority (EBA) published an updated Report on the monitoring of Additional Tier 1 (AT1), Tier 2 and total loss absorbing capacity (TLAC) and minimum requirement for own funds and eligible liabilities (MREL) instruments of European Union (EU) institutions.

ESMA performs an analysis of the cross-border investment activity of firms

The European Securities and Markets Authority (ESMA), the EU's financial markets regulator and supervisor, and national competent authorities (NCAs) completed an analysis of the cross-border provision of investment services during 2022.

EBA publishes fourth Opinion on money laundering and terrorist financing risks across the EU

The European Banking Authority (EBA) published its fourth biennial Opinion on the risks of money laundering and terrorist financing (ML/TF) affecting the European Union's financial sector.

ECB surveys Europeans on new themes for euro banknotes

Time for the new EURO banknote designs

EBA publishes validation requirements on initial margin models

EBA publishes validation requirements on initial margin models.

Marketing requirements and marketing communications under the Regulation on cross-border distribution of funds

This report is therefore the second ESMA’s report under the Regulation.

ECB welcomes European Commission legislative proposals on digital euro and cash

The European Commission has published its legislative proposal on a digital euro.

ESMA publishes Guidelines on templates for summary resolution plans and for written arrangements for resolution colleges

This publication follows that of the Commission Delegated Regulations 2023/1193.

The EBA publishes the final amending ITS on supervisory disclosure under CRD

The European Banking Authority (EBA) published today its final draft amending Implementing Technical Standards (ITS) on supervisory disclosures, which specify the format, structure, contents list and annual publication date of the supervisory information to be disclosed by competent authorities.

Consultation on the first batch of Digital Operational Resilience Act (DORA) policy products

From 19 June 2023 to 11 September 2023

Euronext launches European SME ecosystem ELITE for Dutch private companies

ELITE is Euronext's European ecosystem of private companies accelerating growth and access to private and public capital.

Financial regulation: agreement on a mandate to start negotiations on EU budget rules

Align the financial regulation with the multiannual financial framework (MFF) package

EBA updates list of other systemically important institutions

The list is available also in a user-friendly visualisation tool.

Money market funds stress tests – overall resilience whilst LVNAVs exceed threshold in liquidity and credit risk scenarios

The European Securities and Markets Authority (ESMA), the EU’s financial markets and securities regulator, has published an article on the results of the Money Market Funds (MMFs) stress tests reported to ESMA.

EBA releases the technical package for phase 1 of its 3.3 reporting framework

The European Banking Authority (EBA) published the technical package for phase 1 of version 3.3 of its reporting framework.

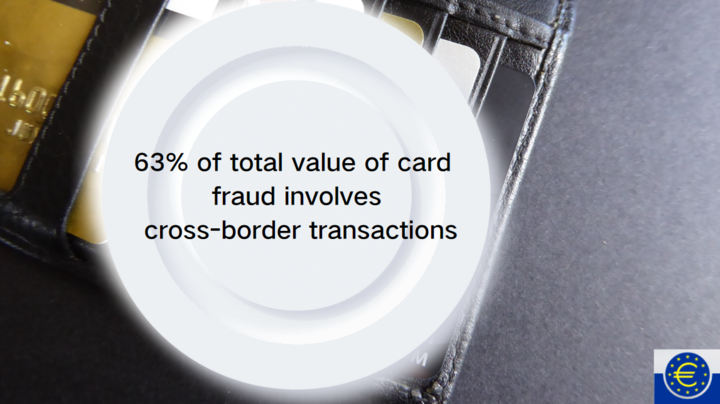

Card fraud in Europe declines significantly

The highest share of card fraud observed to date was 0.048% in 2008.

ESAs propose ESG disclosures for STS securitisations

These final draft RTS aim to help market participants make informed decisions about the sustainability impact of their investments.

ESMA seeks input on rules for long term investment funds

ESMA invites comments on all matters in this paper and in particular on the specific questions summarised in Annex 1.

G7 Leaders' Statement on Economic Resilience and Economic Security

Enhancing global economic resilience;Responding to harmful practices that undermine international rules and norms

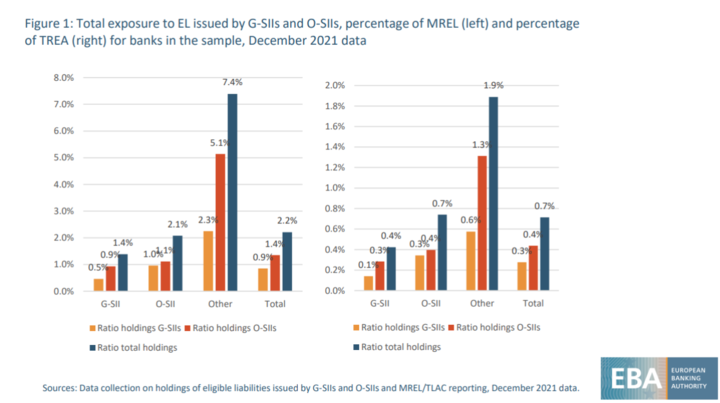

EBA publishes Report on holdings of eligible liabilities issued by G-SIIs and O-SIIs

The European Banking Authority (EBA) published today a Report on the holdings by EU banks of minimum requirement for own funds and eligible liabilities (MREL) instruments issued by the most systemic European banks.

ESAs draw consumers' attention to how rises in inflation and interest rates might affect their finances

HOW DO INFLATION AND THE RISE IN INTEREST RATES AFFECT YOUR MONEY?

ECB Consumer Expectations Survey results – March 2023

ESMA recognises four new Third Country CCPs

Eurex April 2023 figures at Eurex

EBA makes supervisory reporting requirements easier to navigate

Eurosystem to explore new technologies for wholesale central bank money settlement

ESMA finds data quality significantly improves under new monitoring approach

EBA updates list of institutions involved in the 2023 supervisory benchmarking exercise

EBA consults on the draft Guidelines on the STS criteria for on-balance-sheet securitisations

Banking Union: Commission proposes reform of bank crisis management and deposit insurance framework

Euro area monthly balance of payments: February 2023

ESAs propose amendments to extend and simplify sustainability disclosures

Euronext announces highest cash volumes in a year in March 2023

EBA issues Guidelines to challenge unwarranted de-risking and safeguard access to financial services to vulnerable customers

ECB Consumer Expectations Survey results – February 2023

ELITE and WTC Lisboa launch an International Academy to support Portuguese companies to grow

Euronext publishes its 2022 Universal Registration Document

EBA consults on amendments to Guidelines on risk-based AML/CFT supervision to include crypto-asset service providers.

EBA publishes new set of indicators to identify potential causes of consumer harm

ESMA updates its guidance on product governance

Euronext rapeseed futures crash through €450/mt, no bottom in sight

Successful launch of new T2 wholesale payment system

EBA issues revised list of validation rules 10 March 2023

ECB and the ESAs call for enhanced climate-related disclosure for structured finance products

The European Supervisory Authorities[1] (ESAs), together with the European Central Bank (ECB), today

EBA publishes annual assessment of banks' internal approaches for the calculation of capital requirements

EBA issues revised list of validation rules

Euronext announces volumes for February 2023

ESMA publishes the results of the annual transparency calculations for equity and equity-like instruments

EBA publishes final revised Guidelines on methods for calculating contributions to deposit guarantee schemes

Statement regarding recent press speculation

ESMA publishes latest edition of its newsletter

Euronext launches the BEL® ESG index

EBA publishes final draft technical standards

ESMA sees high risks amid fragile markets

Europe's big bet on crypto regulation

Euronext extends the access to Norwegian capital markets

EBA clarifies the application of strong customer authentication requirements to digital wallets

ESMA publishes data for the quarterly liquidity assessment of bonds

Euronext Brussels Awards 2022

EBA publishes its annual quantitative monitoring report

ESMA Eyes Marketing of Financial Products in EU, Focuses on Risky Instruments

EURONEXT PLAGUED BY WEAK FX, DERIVATIVES TRADING VOLUMES

EBA's José Manuel Campa: 'We are here to help solve problems'

Engaging with ESMA but alternative arrangements also under deliberation: RBI report

The largest stock exchange in Europe

EBA Guidelines On The Use Of Remote Customer Onboarding Solutions

ESMA appoints new member to its Management Board

Agricultural Bank of China International Helps Dongfang Shenghong GDR Successfully Landed on the Swiss Exchange

This project is the largest GDR issuance with the largest financing scale since the beginning of this year, and Agricultural Bank of China International once again participated in this issuance as the only Chinese bank background investment bank in the underwriting group.

Euronext expands ELITE's geographic footprint to Portugal

EBA consults on new Guidelines to tackle de-risking

ESMA AMENDS AND CONSULTS ON STANDARDS FOR BENCHMARK ADMINISTRATOR APPLICATIONS

REVO Insurance S.p.A. transfers to Euronext STAR Milan

Borsa Italiana, part of the Euronext Group, today congratulates REVO Insurance S.p.A. on its transfer from Euronext Growth Milan to Euronext STAR Milan.

EBA publishes final technical standards on the measurement of liquidity risks for investment firms

The European Banking Authority (EBA) today published its final Regulatory Technical Standards (RTS) on specific liquidity measurement for investment firms under the Investment Firms Directive (IFD).

EU financial regulator derecognises 6 Indian clearing houses

EU’s decision to derecognise Indian clearing houses comes amid a standoff between Indian and foreign regulators. Sebi and RBI do not want Indian institutions to come under the scrutiny of foreign regulators as they think it is jurisdiction issue.

Dolphin Drilling lists on Euronext Growth

11th listing on Euronext Growth Oslo and 66th listing on Euronext so far in 2022; Brings the total number of companies listed on Euronext Growth Oslo to 115; Market capitalisation of approximately NOK 1.9 billion.

11th Annual Research Workshop - Technological Innovation, Climate Finance and Banking Regulation

DATE : 26/10/2022 08:30 - 27/10/2022 16:30 (PARIS TIME) DURATION: 08:30 - 16:30 (PARIS TIME) LOCATION: EBA PREMISES, PARIS LA DÉFENSE

Competent authorities have applied a risk-based approach to the supervision of ICT risk management

The European Banking Authority (EBA) published the conclusion of its peer review of how competent authorities supervise institutions’ ICT risk management and have implemented the EBA Guidelines on ICT risk assessment under the supervisory review and evaluation process (SREP). Overall, the analysis suggests that the competent authorities across the EU have applied a risk-based approach to the supervision of ICT risk management. The EBA has not identified any significant concerns regarding the supervisory practices but makes some general recommendations for further improvements.

Basel Committee publishes evaluation of buffer usability and cyclicality in its regulatory framework

The Basel Committee on Banking Supervision issued a second report on its evaluation of the impact and effectiveness of implemented Basel reforms.

ESMA updates Q&AS on MIFID II and MIFIR commodity derivatives topics

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has today updated its Questions and Answers (Q&As) on commodity derivatives topics under the MiFID II and MiFIR.

Euronext launches new Eurozone Banks Dividend Index Future today

Euronext extends the scope of derivatives contracts available on the Euronext Eurozone Banks Index. Market participants can now take positions on the Euronext Eurozone Banks Dividend Index Futures Contract, in addition to the existing Futures and Options contracts.

Bank funding: evolution, stability and the role of foreign offices

Key takeaways Bank funding sources have been shifting: from cross-border to local funding, which enhances stability, and, within cross-border funding, from inter-office to unrelated sources, increasing volatility. Shifts in the funding mix of local banking systems stem from the declining share of foreign banking offices, which rely more heavily than domestic offices on cross-border and inter-office funding. The retreat of foreign banking offices has increased the concentration of nationalities in local banking systems, which is associated with heightened funding volatility.

EBA issues revised list of validation rules

Russian war adds uncertainty and volatility to EU financial markets

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, today publishes the second Trends, Risks and Vulnerabilities (TRV) Report of 2022. The Russian war on Ukraine against a backdrop of already-increasing inflation has profoundly impacted the risk environment of EU financial markets, with overall risks to ESMA’s remit remaining at its highest level.

Successful completion of the migration of Euronext’s Core Data Centre

Migration of Euronext’s Core Data Centre from Basildon, UK to the Aruba Global Cloud Data Centre in Bergamo, Italy has been successfully concluded on 6 June 2022. New green Core Data Centre migration was a major step in achieving Euronext’s ESG goals as part of its “Fit for 1.5º” commitment.

EBA calls for more proactive engagement between supervisors in anti-money laundering and counter-terrorist financing colleges

EBA observes that most competent authorities have devoted resources to ensure effective functioning of anti-money laundering and counter-terrorist financing (AML/CFT) colleges. EBA finds that ongoing cooperation and proactive information exchanges between supervisors has not been fully achieved yet in all AML/CFT colleges. EBA recommends the organisation of AML/CFT colleges to be more risk-based.

European institutions eyeing Chinese asset management licenses

AUM, Europe's largest asset management giant, is reported to be preparing to apply for a public fund license in China.

Esma updates the European single electronic format reporting manual

The European Securities and Markets Authority today published the annual update of its Reporting Manual on the European Single Electronic Format .

Condor Technologies to Reopen Trading on the Euronext Exchange in Paris

Condor Technologies's trading sessions on August 23rd for Condor Technologies (MLMFI.PA) on the Euronext Access Exchange in Paris.

Banks relieved as EBA punts on dual-track stress tests

European banks breathed a sigh of relief last month after the European Banking Authority backed away from a long-mooted split structure for its 2023 stress tests, opting instead for a hybrid approach.

ESMA provides comments on first draft of European sustainability reporting standards

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has responded to the European Financial Reporting Advisory Group’s (EFRAG) public consultation on the first set of draft European Sustainability Reporting Standards (ESRS).

Guide to the latest ESG EU regulatory initiatives

The European Commission published its action plan on sustainable finance in 2018, with the aim of creating a roadmap for sustainable finance across three categories:reorienting capital flows toward a more sustainable economy; integrating sustainability into risk management; fostering transparency and long-termism.

EBA consults on technical standards to help originator institutions determine the exposure value of synthetic excess spread in securitisations

The proposals set out in this Consultation Paper will contribute to a more risk sensitive prudential framework in the area of synthetic securitisation. The consultation runs until 14 October 2022.

ESMA updates on applications for recognition from U.S.-based CCPs

The European Securities and Markets Authority (ESMA), has announced its recognition of two central counterparties (CCPs) established in the United States (U.S.) .

EBA Makes Available Online Tools to Submit Answers to Its Study of Cost of Compliance with Supervisory Reporting

Financial Stability, Financial Services and Capital Markets Union - Organisation Chart

EBA Publishes Its 2019 Annual Report on Resolution Colleges

Europe Needs A Fully Fledged Capital Markets Union – Now More Than Ever