Markets increasingly sensitive after strong performance in early 2024

The European Securities and Markets Authority (ESMA), the EU's financial markets regulator and supervisor, today publishes its second risk monitoring report of 2024, setting out the key risk drivers currently facing EU financial markets. External events continue to have a strong impact on the evolution of financial markets, and ESMA also sees high or very high overall risks in the markets within its remit.

Less volatile markets earlier in 2024 and a return of search-for-yield behaviour in riskier market segments suggested a general market anticipation of a ‘soft landing’. However, more recent events show how markets remain very sensitive, especially to interest rate developments, deteriorating credit risk and to political and electoral news. There remains a high risk of corrections in a context of fragile market liquidity, in equity and in other markets.

Verena Ross, ESMA's Chair, said:

“Markets are getting more nervous about the economic outlook and political events, as the dip in equity valuations in early August and market volatility around recent European and French elections shows.

Close monitoring of the financial markets in our remit and strong coordination of supervisory efforts with national authorities remains our priority.

We continue to see risks in the fund area linked to liquidity mis-matches, particularly in the real estate sector, and deteriorating quality of assets linked to interest rate, credit risk and valuation issues.”

Beyond the risk drivers, ESMA's report provides an update on structural developments and the status of key sectors of financial markets, during the first half of 2024.

Structural developments

Market-based finance:Capital availability for European corporates through capital markets has been broadly stable in 2024 so far. Although the market environment remains very challenging for equity issuance, there were signs of improvement in IPO activity. Corporate bond issuance was high in 1Q24 but fell in the second quarter of the year. The corporate bond outlook continues to show a significant upcoming maturity wall from 2024 until 2028. In this context, corporate debt sustainability remains a considerable risk, especially in lower quality segments.

Sustainable finance:In the last few years, a strong interest in and uptake of sustainable investments has been sending positive signals about investors’ willingness to finance the green transition. However, recent ESG-related market developments have sparked concerns on the ability to mobilise private capital, with green bond issuance slowing and sustainable funds facing outflows for the first time in 2H23. Looking ahead, firms' ability to announce credible transition plans could steer broader willingness to invest in transitioning firms, supported by transition finance instruments.

Financial innovation:Crypto-assets markets continued to surge in the first half of 2024, fuelled by the approval of spot Bitcoin and Ether ETPs in the US, to reach a total global market valuation of EUR 2.2tn by end-June (+40% since end-2023). Liquidity also recovered to pre-FTX levels. However, the market developments in early August led to volatility and some substantial falls in crypto-asset valuations. High concentration also continues both for crypto-assets and crypto exchanges.

Market monitoring

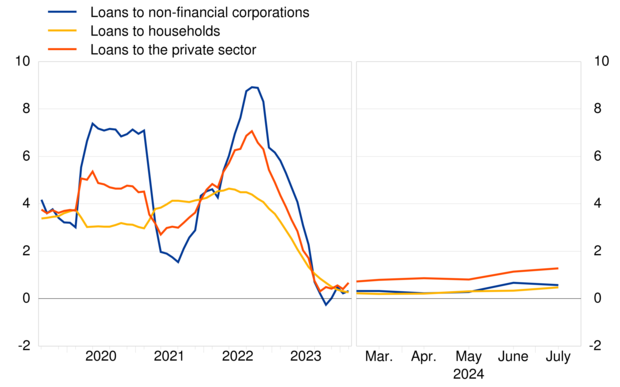

Securities markets: Asset prices in early 2024 trended upwards with little volatility suggesting future rate cuts were being anticipated. Episodes of market volatility took place linked to elections in the EU in June and July, and a short-lived dip in global equity valuations in early August was associated with weaker-than-expected US macroeconomic indicators. In fixed income markets, corporate bond spreads have continued to fall, especially for high-yield corporates while the credit quality of high-yield non-financials has continued to decline, particularly real estate. This may indicate search-for-yield behaviour with a possible underestimation of risks.

Asset management: EU fund performance was positive across categories and funds exposed to fixed income instruments (bond funds and MMFs) recorded inflows. The increase in interest rates has been offset by a broad-based market perception of declining credit risk, reflected in low credit spreads. However, bond fund portfolio credit quality, as measured by credit rating, has continued to deteriorate, raising the risk of a disorderly repricing of risky assets. Risks continue around liquidity risks and potential losses related to interest rate, credit risk and valuation issues. Open-ended real estate funds remain particularly vulnerable given their structural liquidity mismatch and downward pressure on valuations in housing markets.

First, please LoginComment After ~