Basel Committee publishes G20 progress report on the 2023 banking turmoil and liquidity risk

The Basel Committee on Banking Supervision is today publishing a progress report to the G20 Finance Ministers and Central Bank Governors on its analytical work of the 2023 banking turmoil. The report, requested by the G20 Brazilian Presidency, provides an update on the Committee's analytical work on liquidity risk dynamics observed during the turmoil. It builds on the Committee's stocktake report published in October 2023.

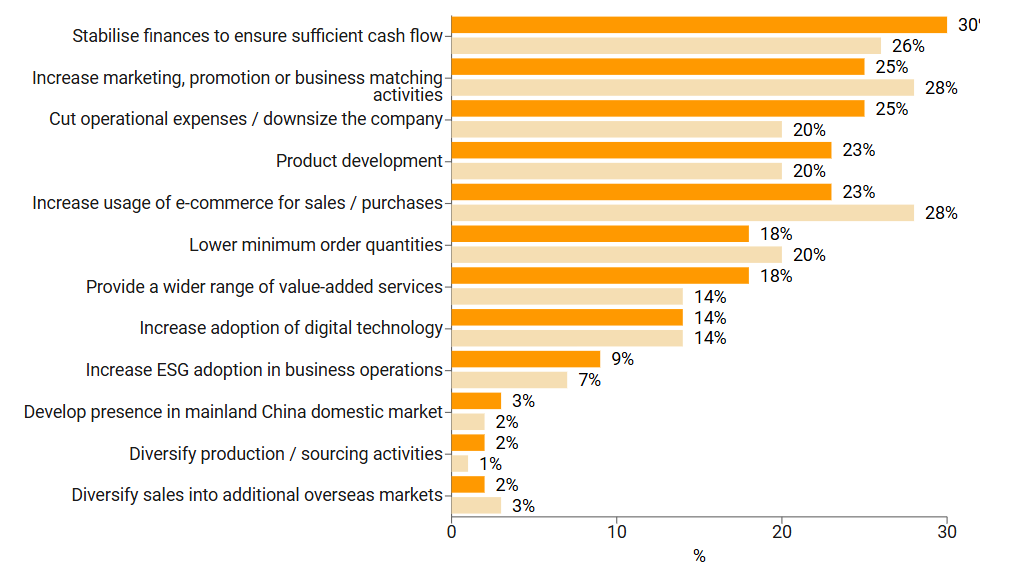

The progress report includes updated empirical analysis on the liquidity outflow rates experienced by distressed banks during the turmoil and assesses the materiality of liquidity risk factors that are not explicitly covered by the Basel III Liquidity Coverage Ratio (LCR). The report also analyses the impact of the accounting treatm ent and valuation of liquid assets eligible to meet the LCR and other potential impediments to banks' ability and willingness to draw down their liquidity buffer. It also assesses the use and role of supervisory monitoring tools and other stress indicators.

Drawing on the findings of this progress report, the Committee is continuing to pursue a series of follow-up initiatives related to the turmoil, including:

·prioritising work to strengthen supervisory effectiveness and identify issues that could merit additional guidance at a global level; and

·pursuing additional follow-up analytical work based on empirical evidence to assess whether specific features of the Basel Framework, such as liquidity risk and interest rate risk in the banking book, performed as intended during the turmoil and assess the need to explore policy options over the medium term.

This follow-up work is fully in line with the imperative of implementing the Basel III standards in a full and consistent manner, and as soon as possible.

First, please LoginComment After ~